When I started college, I had always wanted to be a counselor. I wanted to help people and understand why people do the things that they do.

I knew that I would need to go to graduate school to pursue this career but it was something I had wanted to do for a long time.

Then, during my very last semester of college, I decided I didn’t want to go to school anymore. I was over it and wanted to go to work instead.

I don’t remember exactly what made me change my mind, but there I was 4.5 years in and $28,000 in loans, changing my mind!

I had minored in criminal justice because I had a fascination with criminal profiling, serial killers, and why people do those kinds of things.

So, I decided I would become a police officer in the hopes of becoming a detective instead. My father-in-law (well soon to be at the time) was a state trooper and took me on a ride along with him one night.

It was do dang excited! I was hooked, I knew I wanted to do it too.

That’s what I ended up doing for over 10 years until I paid off my student loans (and all my other debt) and was able to stay at home with my kids.

How We Paid Off $25,000 in Student Loans in 10 Months!

Our debt free journey began in May of 2014. We were in the middle of building a gigantic chicken coop since I surprised my husband with chicks while he was working one night when I discovered Dave Ramsey.

I was stressing about paying off a credit card that I put taxes we owed to the IRS because of a stupid 401(k) loan that turned into a complete disaster. I put what we owed onto a 0% credit card for 18 months and then realized that I didn’t have a plan to pay it off in that time.

I read the book The Total Money Makeover and was hooked. I then quickly became obsessed with making a budget and paying off debt.

Not only did we pay off that credit card but ALL our debt (except the mortgage) before the 18 months were up. My student loan debt was the largest and last thing we paid off. I was able to pay off my student loans in 10 months!

We did not have an extravagant income, I was working as a detective for a small agency outside of Charlotte. We decided that we wanted to be debt-free so that we could have more freedom.

I was not happy at work and wanted the option to stay at home if I wanted to. This is how we did it, if I can do it, so can you.

Created A Zero-Based Budget

When we started our debt free journey we had around $45,000 in consumer debt (not including the mortgage). We owed $25,000 on my student loans, $12,600 on a Yukon Denali, and $6600 to the IRS! UGH.

I had always kept a written budget but to do a zero-based budget was a little bit more challenging. Basically a zero-based budget consists of assigning every single dollar to something.

When I had been doing my budget before, I would write down all the bills each week then I would spend whatever was left without really thinking about it. I didn’t like debt but I figured we were fine since we had money in savings and were saving for retirement.

Cut Expenses

Once we decided to become debt-free, I got busy planning out our budget for the next couple of months. I cancelled anything that was on auto-pay and we didn’t need; like magazines and radio subscriptions.

I quit buying name brand products and started meal planning. Before we started really paying attention to where our money was going, we were spending around $1,200 a month eating out and on groceries.

We cut our grocery budget to $600 a month and $160 for eating out for lunch for two of us. We sold everything we could think of and worked a ton of overtime.

At one point someone even told me to quit “acting like you are destitute.” If you get comments like that on your journey, you are doing it right, keep going!

Sold EVERYTHING!

I sold everything I possibly could! I even sold pictures off my walls and every lamp I had.

If someone would give me money for it, it was sold.

I wanted these student loans gone and the faster, the better.

Tax Refund

We used a tax refund toward our debt. I also adjusted our tax withholdings by using the IRS withholding calculator so that they would take out less and we wouldn’t get as big of a refund.

I also shut off all our retirement contributions during this time.

Related posts:

How a Single Mom Paid off $25,000 in 14 Months!

How One Couple Paid Off $130,000 in less than 2 YEARS!

Tips for Paying Off Debt for Millennials!

Pay off Student loans using Debt Snowball

We paid every extra dollar toward the lowest debt. Once one was paid off we started sending every dollar to the next debt. We knocked out the taxes and Yukon by December 2015. On January 1st, 2016, we started on my student loans.

My original loan amount when I graduated in December 2006 was $28,000. So, in 9 years, I had only paid off $3,000 because of interest.

I got MAD about this and vowed to do everything possible to get them paid off by the end of the year. I calculated how much interest

I was paying daily and it was $4.62. EVERY.SINGLE.DAY.

I stayed motivated by calculating how much we were saving daily as we went along. We ended up paying it off on October 28th, 2016.

If we can do this, so can you. You may not be able to do it in the same amount of time but progress is progress. Stay motivated by keeping track of your progress and keeping a written budget. Make sure that you have someone who can be your accountability partner to help you stay on track.

Tips for Paying off Student Loans Fast

1. Get to work.

Find ways to make extra money, whether that is working overtime or extra jobs. Send all your extra money to your student loan debt to pay it off faster.

2. Sell Everything

When paying off my student loans, I sold everything I possibly could. I even sold my home decor. It looked like I just moved in to my house. I sold everything off my walls, lamps, and lots of kid stuff.

3. Live like a broke college kid

If you want to tackle this debt quickly then you have to keep your lifestyle down.

This means, cut expenses and keep living like you are broke. Don’t let the lifestyle creep get you.

4. Use a debt payoff calculator and see how much the loan is costing you every day

Mine was coming me $4.62 every single day. I stayed motivated by watching the number drop and drop.

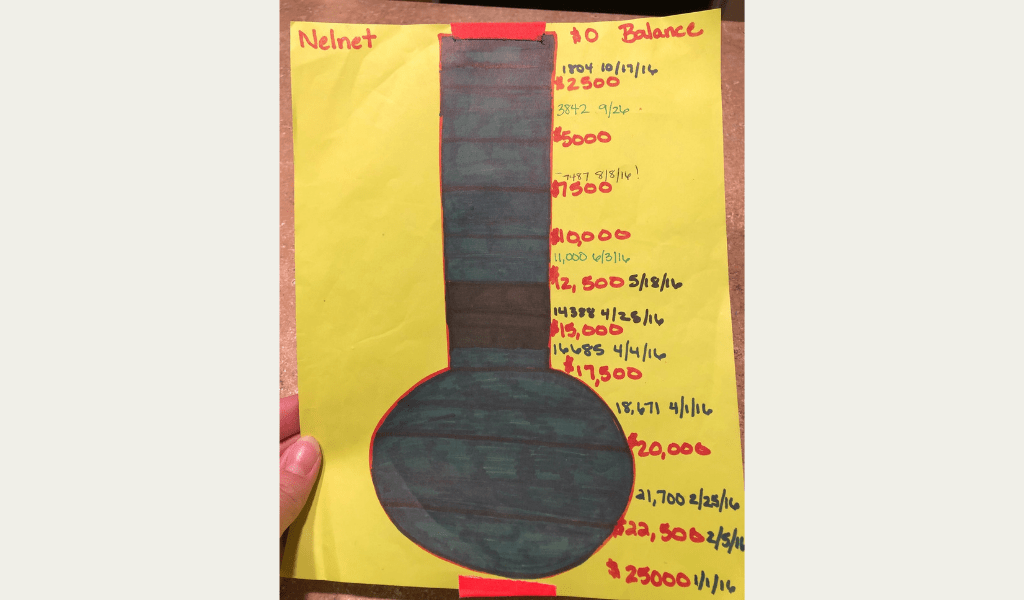

5. Make Visuals

I hand drew a thermometer on construction paper for my student loans. Or you can get a fancy free debt payoff chart at debtfreecharts.com.

Other People Who have Successfully Paid Off Their Student Loans:

I love sharing debt pay off success stories and have shared several that have paid off huge amounts of student loans.

I would read stories like these every night before bed to keep myself motivated while we were paying off debt.

Here are a few of them:

They paid off $24,500 in 7.5 months (on a low income) with student loans making up $21,000 of it. They did this so fast that it still amazes me!

Ashish and his wife paid off $130,000 in student loans in less than 2 years! Yes, that is a huge amount but they were determined and stayed focused without giving into a certain lifestyle.

They did not let the lifestyle creep get them and now they are able to live the life they want.

Holly and her husband paid off $33,000 in student loans and are now paying off their mortgage!

These are just a few stories of people that were able to pay off huge amounts of debt quickly. Is it easy? No, but it’s so worth it!

FAQ:

Why should I pay off my student loans early?

You should pay off your student loans early so that they aren’t following you for the rest of your life. You can not get rid of student loans and the government will garnish your social security income when you retire for not paying them back.

They also can not be charged off in a bankruptcy, can’t be negotiated or settled. They carry a lot of risk with little flexibility.

Student loans should be paid off like you owe the IRS, because basically it’s the same thing.

What if I can’t pay my student loans?

If you can’t pay your student loans, you can attempt to put them on a forbearance or deferment depending on your situation.

You can also try an income based repayment plan as a last resort. An income based repayment plan payment does not even cover the interest that accrues, so this should only be temporary and only if seriously needed.

Should I refinance my loans?

You can refinance your loans but keep in mind that you still need to work as quickly as possible to pay them off. Refinancing can help save money on interest and lower your payment to make it more manageable.

If you have a large amount, it could be beneficial to refinance. However, if you have a small amount, just pay them off fast.

Should I pay off my student loans if they will be forgiven anyway?

YES!!! First of all, the government can change the terms of who and if any loans gets forgiven at any time. Second, you can pay it off faster and save more money by paying it off quickly than making the minimum payment for 10 years to have them forgiven. Third, whatever amount is forgiven counts as income on your tax return which could cost you a lot of money.

Also, you have to qualify for an income based plan to qualify for some of the forgiveness programs. So, you may think you qualify and you may not. It also makes you stuck in a certain job for a long period of time and that may not be what you want. Don’t stay at a job just for the loan forgiveness.

Weigh all your options and the costs and benefits before relying on the student loan forgiveness program. There are other programs out there and if you qualify, then great, do it. But don’t ignore your student loans based on the hopes that some day they will be forgiven.

Should I pay off my students loans or invest?

This really depends on your risk tolerance but I will always lean toward paying them off. It’s a save bet with your money and there is a lot of risk involved with owing student loans.

If you choose to invest instead, you risk losing all your money and still owing the debt.

This would also depend on what your interest rate is for your loans versus how much you could potentially gain in the market. For my student loans, there wasn’t much room as my interest rate was high.

If you pay off your student loans instead as quickly as possible, then you have more money to invest and leave in the market longer to really gain.

If you choose to invest, you are still going to have to make monthly payments and wait on earning on the investments or try to time the market which is never a great idea.

It’s always a safer bet to pay off your loans then use that money toward sound investments.

Should I pay off my student loans or save?

This depends on your situation and if you have any known risks coming up. Meaning, do you have something you need to save for right now.

Are you potentially losing a job, having a child, medical issues, moving, or other big expenses that you know of coming up.

If not, then pay off your student loans now. You can save for things much faster once the debt is gone.

If you have a large expense coming upkeeps then save for it, then focus on paying on your debt.

Your next step:

Now that you can see if is possible to pay off your student loans fast, go out there and do it! Make a plan, create some visuals and JUST DO IT! Get those dang student loans out of your life FOREVER!

Dream and dream big! What can you do with your money when you get to actually keep it?

How much student debt do you have? Let me know in the comments.

Thanks for sharing! I need to get to the point of being MAD as well.

You can do it Andrea!

Great job, I wish I could be as motivated! Did you use any programs or tools to account for everything?

I keep getting side tracked. My computer is old and works when it wants so I’m pretty bound to my phone for stuff like that. Writing it down just means it’ll get shuffled to the back of the pile!!

I’m not a math person, period….

I used an Excel spreadsheet for the last year. It makes it easier to keep track of things and make changes compared to pen and paper. There are programs that you can use on your phone to keep track of your budget, but I didn’t use them.

Everydollar is available as an app or on your computer. It is free and great for keeping you accountable.

Great post! My husband read the same book many years ago and it helped him pay off a large amount of consumer debt. He still references the snowball method today. We too have spent the last year focusing on paying off debt and have gotten down to the mortgage, cars and small $8000 student loan (which I plan to tackle next). Having nearly $60,000 in student loans between the two of us took awhile to pay off but we’re getting there.

I’m anxious to hear about how to budget better and incorporate meal planning into that. Those are my two weak points!

It is an a great program! We are now saving our emergency fund. By the end of the year we should have that done, fund our retirement accounts and pay for a trip to Disney!

Wow, you are doing great! Keep it up and you will get there. You have done the hardest part already, which is getting started! I like to read other people’s stories to keep motivated and looking back at my own progress helps too.

Ashely’s advice really works. She coached me through paying off $11k in student loan/cc debt in less than a year. And like she said, it helps to have an extremely supportive and understanding husband/partner to keep you accountable and moving forward.

You did a good job Travis!

Thanks for sharing your journey!!! What a great feeling to pay off a major debt.

Thank you!

You should be so proud of what you have accomplished, congratulations. You are inspiring!

Thank you so much! It was a lot of hard work but so worth it!

Thank you! I appreciate the support!

What motivation you have! That’s great! You’ll be buying your next vehicle with cash! We only owe our mortgage but will need another vehicle soon. I should be more careful of food spending.

The plan is to pay cash for our next vehicle but we haven’t started that fund yet. We are working on our emergency fund first and then will start on that. So, hopefully our cars don’t have any major issues before then. Luckily for me, my husband is a mechanic, so it will have to be major to cause us to buy something before we can pay cash for it.

Hi! We are currently in the exact same position. Tax time is here and I am scared. They are taking $1000 out each month right now and that doesn’t include our medical bills (3,000), student loan (15,000) and car repair bill ($5000). I don’t know where to turn. Help!!

Ann, do you have a written budget? I would suggest starting there, if you haven’t already. Then it’s time to sell everything! Check with your student loans to see if you qualify for any programs to lower the payment for now, while you work on the plan. Have you read any of Dave Ramsey’s books? I would read The Total Money Makeover first, check it out at the library if you have to. It will give you a great head start!

Hi what a great post and congrats on being debt free! I’m trying myself but it’s hard – I would like to know how you did it though? I don’t even earn £25k in a year so me trying to pay that kind of money off in 10 months it’s just physically impossible. Unless I win the lottery!

Thank you! It may take you longer but keep going! Everyone is different, the important thing is to start and just keep going!

Thank you! Keep up the good work!

Great article! We are also working on our debt free journey. We still have those pesky student loan payments but have gotten rid of our second mortgage and all credit card debt. Now when I look at people living a lavish lifestyle, I think to myself “how much debt do they have.” 🙂

Great article! We are working on our debt as well. We still have student loans, but have paid of the second mortgage and all credit card debt. Now when I see people living lavish, instead of being envious I think, “I wonder how much debt they have.”

I do the SAME thing! Keep up the good work!

Very impressive! Great job. It must be so freeing to have that debt behind you for good.

It is great! Thank you!

This was a great post, I am going to have to save this for later reference!

Wow that’s great! Keep up the good work!

That’s so awesome! Congrats! My husband is obsessed with Dave Ramsey! We listen to him all the time!

My husband says I’m obsessed too. I make him listen to his podcasts all the time!

I started at 92K and have 28K to do by doing similar things. The interest is the WORST! Way to go!

Interest is terrible. Good job on your progress! I can’t wait to hear when you are debt free!

I can only imagine but you can be debt free also! It just takes time and a plan.

Great planning. I wish I could plan it the way you guys did. My wife is a bit of spender and just in a few months I will have to take up a huge loan. I will keep your planning style to understand how to decrease my debt quickly.

So impressive! My husband and I are committed to getting our big payments done in the next 10 years. We are over 75% done with paying our car off. My husband has student loans, which are a big part of our budget, but since he’s a teacher, he qualifies for forgiveness after 10 years (yes!) Otherwise, we live relatively debt free–no credit cards, nothing! We don’t use auto-payments or anything like that to prevent problems.

This is super impressive and amazing motivation to start a budget!

Sophie | MapleTreeBlog

Congratulations! That’s a huge accomplishment!

WoW!!! Congratulations! I need to adapt my strategy and do this! I appreciate this post so much. Thanks for the GREAT read.

Wow congratulations! My loan amount is WAY higher and intimidating but I may have to start somewhere. Definitely crazy how much is spent without knowing each month!

Congratulations!! Getting debt off the balance sheet is so key to so many important things in life (including how you feel) 🙂 Nice work, and congrats! Cheers, Mary Jane

Congratulations on beating the debt! I don’t have a lot of consumer debt but I always worry about living within or below my means…

Congratulations, it’s a good point that lots of people spend so much money on non-necessary things without even thinking about it. I imagine you both had steady, good jobs though?

Thanks so much for sharing not only what you did but how you did it! 🙂 It’s so inspiring! 🙂 We really need to set up a budget as we are looking at buying a house, and so the more money we have saved the better. I’m not shopping for 6 months which helps but it would be good to budget and be more consistent 🙂

Hope you are having a great week 🙂

Away From The Blue Blog

Wow congrats, unfortunately my student loan debt is $80k

Wow that is a HUGE accomplishment. Well done you! We’re trying to keep a balance – pay off debt as much as we can while still putting aside some money for retirement. And we take advantage of 0% interest offers the bank sometimes have too.

I love this! I am a student right now trying to save my first 1,000 for an emergency fund and knock out the last $800 of credit card debt before signing up for classes again. I love your determination on your “paying off” journey. Being mad creates a fire in us all haha, no debt stands a chance against a determined individual.

So grateful for this post! I have so much student debt to clear and feel like I’m making no progress at all. I’ve heard a bit about these zero-based budgets but not really read into them so thanks for the explanation – it might be something I try from next payday!

Dani x

Great post..the worst part in debt is interest. Helps every one to plan

Okay that’s amazing!!!! Great job you guys!

xx,

Lacey

Awesome! I started at 24,000 and we’re over halfway down! I can only imagine how great it’s going to feel when it’s gone!

My anger towards Sallie Mae/Navient is what propelled my journey to being debt free also. I was able to use pretty much the same technique that you described to pay off 85K in student loan debt in 6 years. I have been completely debt free since 2015. My husband became inspired and he finally paid off his last piece of debt in 2016. I always say we are the richest poor people I know 🙂 its honestly a great way to live! I have so much freedom knowing that I never have to worry about another bill. Thank you for sharing your journey and a HUGE CONGRATS!!!!!!!!!!!!!!!!!!!!!!

WOOT! This is so amazing!! You have inspired me for sure. This is on my list of things to accomplish next year.