Being frugal is all about saving money on some things so you can spend money on other things. It’s all about prioritizing your money and spending on what is important to you.

That will look different to everyone depending on your likes and dislikes and priorities.

I have compiled a list of ways you can be frugal in order to save money for things you really want, like paying off debt. These frugal living tips will have you saving money fast!

These are some of the ways that I save money and you can too. It doesn’t have to be anything crazy, just simple small steps every day that add up to big results at the end of the month.

Saving money doesn’t have include giving up a kidney or your left arm just to save money.

It takes paying attention to where your money is going on a daily basis and stopping it from slowing leaving you every day. Those $5 and $10 “little” trips to the store here and there adds up to big amounts of money at the end of the month.

When you track your money everyday and pay attention to how slowly it leaves you, it is easier to stop it and save it.

These simple saving money tips may not seem like much all by themselves but they add up slowly and will have a major impact on your monthly budget.

Some of these tips may not even seem super frugal but overall they will save you money so you can spend money on the things you really want.

Get my top 100 MORE SAVING MONEY TIPS straight to your mailbox!

What is frugality?

Being frugal and being cheap are two very different things.

There is a big difference between being cheap or frugal. I used to think I was cheap but I learned that I am actually frugal.

Being frugal is about saving money and being thrifty so you can buy the things you want.

Being cheap is saving money at all costs even when it’s not practical or ruins relationships.

According to Wikipedia, the actual definition of frugality is “the quality of being frugal, sparing, thrifty, prudent or economical in the consumption of consumable resources and avoid waste.”

So, what does it mean to be “cheap”? Cheap is only about spending less. Being cheap doesn’t take into account other factors, like durability, quality, and long-term cost vs benefit ratio.

According to the Merriam-Webster Dictionary, cheap means:

1: obtainable at a low price or

2. inferior quality or

3. stingy

The only one of those that sounds good is a low price! Being cheap can mean not being generous. It is also buying things at the lowest price without considering your time. Being cheap means saving money in the short-term to the detriment of everything else.

Being frugal is about saving resources. It can also mean prioritizing spending. So, someone that is frugal saves money on some things so they can spend money on other things that are more important to them.

Someone is frugal when they save money and resources but still place value on quality, their long-term goals, and their own time.

What are the benefits to frugal living?

What is great about living frugally is that you get to buy the things you want because you save money on less important things.

It’s all about your priorities and it doesn’t mean you save money at all costs.

You get to spend money on what you want, even if it costs more.

That is the great thing about being frugal.

You don’t even have to be extreme about it.

It’s just about prioritizing your money so you can spend on the things you want.

Here are 100+ Frugal Living Tips:

I have divided them up by categories to make it easier for you to find certain tips since this list is so long.

Keep in mind that you do not have to implement all or even a majority of these frugal living tips to see results.

This list is long but you can get my Top 15 Money Saving Tips for free above.

Money Saving Apps and General Tips

1. Use cash and save 15%-20% on average on every purchase!

Studies have shown that you analyze spending cash differently compared to swiping a card. This causes you to spend less with cash.

Using cash envelopes and following this guide will help you overcome the common fears of using cash and answer the most common questions that I get about it.

It doesn’t have to be scary and stressful and will save you money every single month. It will help you stick to your budget and stay accountable.

2. Make a budget & stick to it!

Making a budget is the foundation for saving money and paying off debt. This will help you find money you probably don’t even realize you had and help you save your money.

You will automatically save money doing your budget and easily be able to see areas that you can save on expenses.

Planning out your budget even for busy families is doable and will help you manage your money and start saving money.

3. Use Digit.

Digit has a free trial and will allow you to automatically save money on every purchase. What is great about Digit is that it is free to sign up and they save your money automatically towards the goals you choose. You don’t even have to think about it.

This app has turned me from someone who can’t save money into someone who can. -Brooke

4. Sign up for Billcutterz

I used Billcutterz last month and it was so unbelievably easy and they saved me over $100! All I did was send them one bill. Billcutterz is a service that uses actual people to save you money. It is more effective than a roboservice like Trim.

They know who to talk to at each company and can even save you more money that you can yourself. They saved me more than I saved myself calling the year before. Plus they negotiate again for you once the savings is up. You don’t even have to remind them, they do it all for you.

5. Use Trim so save on bills.

Trim is a service that negotiates your bills to lower your expenses for you. It’s also free to sign up. This service is similar to Billcutterz but is more involved with signing up and may not be as effective. It is a roboservice and not actual people working on your behalf.

6. Use Ebates

Ebates gives you cash back on your purchases online. It’s fast and easy to use.

You earn money while shopping online at places you were already going to shop at. They even have a browser extension so you don’t have to go through their website every time. It will automatically ask you if you want to earn money back when you are on a site that they offer it.

It could not be easier to earn money back while shopping.

Plus you get money for referring your friends to use it. It’s free and there’s no risk involved.

They even send you cash. You don’t have to get a gift card (but you can).

7. Use Swagbucks

Use Swagbucks and earn cash back on purchases plus you can earn money doing surveys. You get to earn money back from purchase you were already going to make at places like Amazon, Target, Walmart, and many others. You basically get paid for shopping and then get paid for doing surveys.

You even get paid for referring your friends!

8. Invest your change with Acorns

Acorns invests your change for you. It may not be a huge amount but over time, every little bit counts. They do all the work for you and you can painlessly invest your money.

9. Use coupons

Coupons can be a huge way to save even if you don’t go extreme.

Plus most stores have electronic coupons now which makes it even easier to save money. You don’t have to waste a ton of time clipping coupons and looking for newspapers.

10. Use Groupon for deals and coupons.

Groupon is amazing! It’s a free site to find all kinds of special offers, local deals, coupons, and so much more. There’s always new stuff and great deals. It’s incredibly easy to use and

11. Plan a no-spend weekend.

This will have more impact if you can do it longer. There are no hard and fast rules on how long to do it. You decide what you want to do and how long then make it happen. I even have a planning checklist to help you get ready!

12. Refinance your student loans to save interest.

When I started my debt-free journey, I had $25,000 in student loans. I was paying almost $5 every single day just in interest, $4.64 to be exact!

I knew I was going to be paying it off quickly so it didn’t make a difference to refinance. However, if I would have had a larger amount and it would have taken longer, it would have been smart to refinance to a lower rate.

This will greatly depend on your situation, how much you owe, and how quickly you can pay it off. But if you can save some money, this is one debt that I suggest refinancing if it makes sense.

Ways to Save on Food:

Saving money on food is one of the easiest and quick ways to save money. This is an area that most families spend a ton of money and can easily cut back. Here are some easy and quick ways to save money on food. These tips save my family over $600 every single month on food.

This is one of the best ways to live frugally and save money so you can spend money on what you really want.

13. Take your lunch to work.

This is healthier and will easily save you money every day. Just be sure not to eat it by 10am like me! 🙂

14. Meal plan & cook at home.

When we started tracking our spending we saved over $600 a month by eating at home. This is usually the quickest way to save money in your budget.

15. Use a shopping list & calculator while shopping.

This will help you stick to your list and not buy things you don’t need.

16. Use a slow cooker instead of the oven.

The oven uses a lot of electricity compared to a slow cooker. Plus you will have dinner waiting for you when you get home!

17. Use a grill instead of the stove.

Not only will this save a little money, the food tastes better.

18. Make meatless dinners at least 1-2 times a week.

Meat is so expensive so making a few meatless meals a week can save you a lot in one month.

19. Use cheaper cuts of meat.

We use a lot of chicken, even ground chicken in place of beef because it is a lot cheaper.

20. Make breakfast for dinner.

Depending on what you make, this is typically cheaper than a dinner meal. My kids love it and I keep it as a backup on my meal plan.

21. Eat leftovers.

This will help you stretch your meals further and can save you a ton of money each month.

22. Freeze leftovers.

If you are sick of a meal, freeze the leftovers to have on a busy night.

23. Stop buying prepackaged snacks.

Packaging your own snacks is so much cheaper than buying them already portioned. Even if you are busy, you can find 10 minutes to package snacks for the week.

24. Have kids take lunch to school instead of buying at school.

Depending on the kid an school district, this potentially could save you money and is healthier.

25. Make your own Lunchables.

My kids love doing this and it’s so much cheaper than buying them already made.

26. Use Fetch Rewards for cash back on groceries!

Just scan your receipt after shopping and earn rewards for cash back.

Use code FETCH2K and get an extra 2,000 points (which equals $2)!

27. Don’t eat at restaurants while trying to save.

If you do, look for coupons and order water.

28. Reuse ziplock bags.

This is good for snacks or things that don’t really grow bacteria. I wouldn’t recommend this with raw meat.

Coffee:

29. Stop going to Starbucks.

This will save you money and will help the environment. Really, just any coffee shop. It will take some adjustment but you can still reward yourself with a special coffee.

You can even turn it in to a challenge and reward yourself with one after now spending the money after 6 days, or something like that. If you try to completely deprive yourself, you will be less likely to succeed.

30. Make your own coffee at home.

Even if you start doing it the majority of the time, it will save money compared to a coffee shop every day.

You can even save some money by buying a higher end coffee while you adjust. Then you can gradually switch out to something cheaper. Even making Starbucks or Dunkin’ Donuts coffee at home would be cheaper than going to the store.

31. Reuse coffee filters.

A reusable coffee filter is cheap and will last a very long time. It is better for the environment and will save you some money.

At Home:

32. Buy generic products.

Most of the time, generic products are just as good as name brand. Sometimes even better.

I know there will be some things you will refuse to buy a generic of but that’s why you save money in other areas. The whole point is to be frugal in some areas so you can spend on other things.

33. Hand wash dishes.

Depending on how old your dishwasher is, this may actually not save any money. My new dishwasher is more cost effective than hand washing but depends on your appliance.

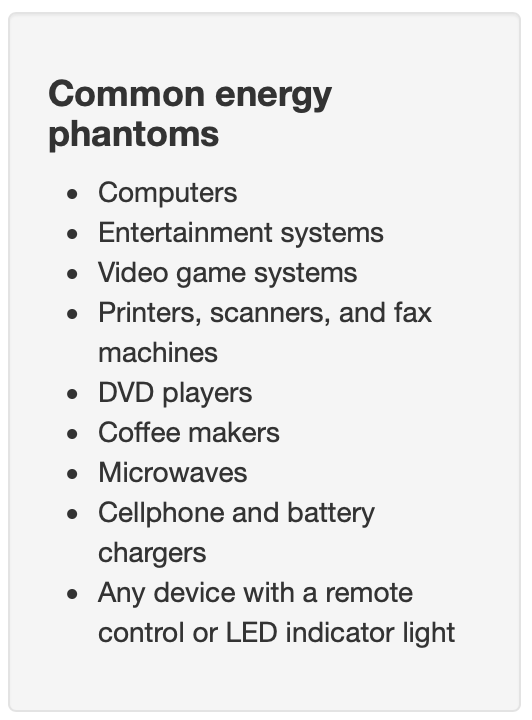

34. Unplug appliances when not in use.

This is a huge savings because even when things are turned off they still use power.

35. Unplug chargers when not in use.

For the same reasons listed above, unplug any chargers when not in use.

36. Use LED or florescent light bulbs.

LED bulbs are a lot cheaper than they used to be and they last forever! They use very little energy and are not toxic like florescent bulbs.

Florescent bulbs are better for energy use than incandescent but still not as good as LED.

37. Insulate your attic.

According to House Logic you can

Save about $600/year by boosting the amount of attic insulation from R-11 to R-49.

Depending on the type of materials you use, figure on paying an insulation contractor about $1,500 to insulate an 800-square-foot attic, which pays back your investment in three years. You’ll spend about half that to do the job yourself.

That’s a pretty big savings and you will be more comfortable in your own home.

38. Insulate your water heater if exposed.

Insulating your water heater will also save you money and help it be ore efficient.

39. Use air dry setting on dishwasher.

A lot of the energy that a dishwasher uses is on the dry setting. You can save energy by letting it air dry.

40. Hang clothes to dry.

Your dryer uses a ton of electricity so if you can air dry clothes, you can save quite a bit of money.

41. Wash clothes in cold water.

Washing clothes in cold water is usually better for your clothes and it saves money by not using hot water.

42. Wash clothes with higher spin cycle so they dry faster in dryer.

The dryer uses a ton of energy and you can save drying time by having your washer spin more of the water out. It will try much faster this way and save on your power bills.

43. Wash full loads of laundry.

This will reduce the amount of laundry you do overall. It will reduce energy and water consumption.

44. Wear items (that can be) more than once before washing.

I know some people will freak over this tip but you don’t have to wash everything every single time you wear it. Some things aren’t even that dirty after wearing it for a little while.

You also don’t have to wash towels after one use.

45. Use dryer sheets instead of fabric softener

Fabric softener is more expensive and really not necessary. It is a luxury.

46. Use powdered laundry detergent instead of liquid

Powdered detergent is just as effective and quite a bit cheaper than liquid.

47. Use cheaper brand of detergent and/or fabric softener

You do not have to use high end products to keep your clothes looking good. Lower cost soaps work just as well.

48. Wash laundry at night

Energy costs are lower at night especially in the summertime. During daytime hours, there is more demand on services, causing higher costs.

49. Use hand towels instead of paper towels

Paper towels are a luxury. It is better for the environment and saves you money to just wash towels.

50. Use old shirts as rags

Old shirts are great for repurposing. They can be used for dusting, protecting furniture during craft projects and so much ore.

51. Use cloth diapers instead of disposable diapers

I have debated if this is really worth the savings. Or really if there is any savings here.

I have used cloth diapers with my youngest and between the loads of laundry, I’m not sure I’m really saving anything lol!

So take it for what it’s worth. There are other reasons to use cloth though and you may save a little bit of money overall.

55. Make your own baby food-

I use the Baby Bullet and it is very handy!

I used to puree vegetables and fruit and then freeze them in ice cube trays. Once they were frozen, I put them in a bag in the freezer. Saves a ton of money on prepared baby food.

56. Buy in bulk at warehouse stores

Buying in bulk can save you money but you do have to be careful with what you buy. Some of the items are not a good price where others are a great price.

It will take comparison shopping and figuring out the cost per unit. Also consider that some take coupons which adds to the savings.

57. Use fans instead of A/C

Fans use less energy than running the whole house A/C.

58. Turn up or down thermostat 2 degrees

Moving the thermostat just 2 degrees can save you quite a bit on your bill.

59. Take showers instead of baths

Taking a shower saves water and hot water. So you would be saving on your water and electric bill.

60. Turn down thermostat on water heaters

This is a good tips especially if you have small children. Your water heater should be at 120 degrees or below for safety reasons.

61. Take a shorter and/or cooler shower

Save hot water and take a slightly cooler shower. This will probably take some getting used to but every little bit adds up.

62. Only fill bath tub 1/3-1/2 way for kids

Kids don’t need a full bath tub. Use less water for them and they won’t really notice.

63. Use low flow shower head

A low flow shower head is easy to install and very cost effective.

64. Cancel cable

You can watch anything on the internet nowadays and most things are streamed. If there is something you can’t watch, there are other ways to find it.

65. Reduce cable channels.

You can even try calling to cancel to get a discounted rate. I have done this several times and have saved about $75 a month by changing channel packages and the discount they give me to keep me as a customer. This may not always work though so be prepared.

Or you can use Billcutterz to call for you. They will negotiate your plan and save you money on your cable bill! It’s so easy and saves you a ton of time and frustration.

66. Use a Roku for Netflix, Hulu and other TV channels.

You can get almost all channels through other services including sports channels.

67. Use an antennae for free local channels

You can get them cheap and get HD channels for free.

68. Cut down on cell phone bill.

Reduce data limits or use a prepaid service. Several prepaid services use large companies like Verizon and AT&T’s towers so you get the same coverage at a much cheaper rate.

69. Get rid of your home phone.

Who still has these anymore?

70. Shop consignment sales.

You can get nice, name brand clothing much cheaper using ThredUp. You can also sell them your clothes and make some money!

71. Shop at used clothing stores

You can find name brands and practically new clothes by shopping for used clothes.

72. Shop at Habitat for Humanity stores for used fixtures

You can get all kinds of things at Habitat for Humanity stores, like doors, windows, trim, appliances, furniture and a ton of other things.

It’s not your typical second hand store.

73. Borrow items from friends

I have to remind my husband of this all the time!

You do not have to buy everything, especially if you are only going to use it once. Ask a friend to borrow somethings once in awhile.

74. Mow own grass instead of lawn service

When you are wanting to live frugally and save money, then paying someone to mow your grass is not the best option. Now depending on your situation, you may need to or you may decide that it’s worth the cost to you.

That’s what is great about living frugally, you get to spend money on what you want because you save money on things that aren’t as important to you.

75. Use free wifi or mobile hot spot instead of home internet service

Home internet service gets more expensive every year and I’m sure that won’t change until everyone starts using hot spots!

I’m sure it will be like cable is now where everyone is ditching it for a cheaper option.

If you have good cell service, using a mobile hot spot may be an option for you.

76. Use Walmart savings catcher

Walmart Savings Catcher is a simple way to make money on purchase you’ve already made.

I mean it’s free money! All you have to do is scan your receipt. That’s it!

Then they send you a gift card to your email.

It literally could not be easier to save money!

77. Water down juice (especially for kids)

You can make juice last twice as long by watering it down.

78. Refill water bottles

Using a water bottle over and over within a day at least saves you from using a ton of bottles throughout the day.

79. Use washable reusable water bottles

You could also skip the water bottle and use a refillable bottle.

80. Drink only water

It’s healthier for you and will save you money.

81. Rent movies from Redbox instead of Pay-per-View

Does anyone still use pay-per-view? You can typically rent the movie from Redbox at a fraction of the cost.

82. Use a Target Red DEBIT card to save 5%

Hey if you are going to shop at Target anyway, might as well save 5%.

83. Use Amazon Subscribe and Save Try Amazon Prime 30-Day Free Trial

Only do this if it is actually saving you money. I ended up cancelling mine because I didn’t need 5 things to make the order.

84. Use Amazon Music for free music Try Amazon Music Unlimited Free Trial

Instead of paying for radio, use Amazon music if you already have Prime.

85. Cancel Amazon Prime if you don’t use it

This will save you not only the cost of Prime but also the cost of shopping on Amazon. A lot of their things are not cheaper but you still use it for the convenience then you grab a few more things just because.

You can live without Amazon Prime, I promise.

86. Unsubscribe from store emails

This is a great way to remove temptation for all the great deals!

87. Cancel paid radio subscriptions

Every little bit counts and you can listen to music for free. Even if it’s only costing you $10 every month, once you add all these little things together, it adds up by the end of the month.

88. Cancel magazine subscriptions

Practically everything is on the internet now for free. Ditch those magazines and save some money.

89. Cancel gym membership- especially if you don’t use it!

Are you really ever going to go to the gym and workout?:)

90. Use Youtube to fix things yourself

My husband is incredibly handy and will use YouTube to learn how to do something if he doesn’t already know. He’s fixed our dryer 3 times already by watching videos.

Most people would have just went and bought a new dryer. I’ve spend about $200 on parts over the last year and it’s still going.

91. Learn to sew to fix your own clothing to wear it longer

Sewing is becoming a lost art but it can save you tons of money. You can use what you have longer. Just beware of the supply costs if you are going to try to save money making your own items. I swear I spend more on supplies than just buying some things haha!

92. Make your own birthday cards.

Cards are so ridiculously expensive! You can also get cards at Dollar Tree.

93. Save gift bags and reuse.

There’s no reason to throw them in the trash. Reusing gift bags is an easy way to save money and help the environment.

Entertainment

94. Have a movie night at home

Get some popcorn and Dollar Tree snacks and enjoy some time with your family for way less than the movie theatre.

95. Go to a local park

Get the family outside and enjoy the environment! They spend enough time on devices, make them go interact with nature.

96. Buy memberships for places like the zoo

Only if you are going to use it. The membership prices are typically cost effective after two visits. Compare the pricing and make sure that you will get your money’s worth if you join.

97. Use the library for free books and movies

Local libraries even have audiobooks and digital rentals all for FREE! If you haven’t been to a local library lately, go check it out.

They even sell the used books super cheap. My library sells paper backs at $0.50 and hardbacks for $1.00!

98. Use public transportation if possible

If you live in a city that offers public transportation, take a break and let someone else deal with the traffic.

99. Travel during off peak seasons

This is great if you aren’t subject to the school calendar. You can find much better rates even by one week if you aren’t set on dates.

100. Use a gas tracker app

There is an app for everything nowadays so you might as well use one to get the lowest price on gas.

101. Look for free local entertainment

Find local Facebook pages or groups including your local town’s pages. There are tons of free things to do it you search for it.

You can also go to local historical landmarks, museums, parks, and other places that are free and you don’t have to spend a ton on gas.

102. Cancel any membership you don’t use

Did you join the gym in January and haven’t gone in weeks (or months)? Call and cancel it.

Cancel radio subscriptions, magazines, subscriptions boxes, anything you really don’t need.

103. Price match-lots of stores including Target and Best Buy price match!

Always check Amazon when shopping around and tell the cashier the price you found. I have found that if it’s a small amount the cashier can easily approve it. If it’s a larger amount, a manger usually has to come over. I saved over $200 on my new computer by price matching on Amazon. I even do it at Target all the time on toys and other things.

104. Use a photographer instead of buying school pictures

This is cheaper the more kids you have. You can even look into a local community college with a photography program. There will be students that need photos for their portfolios and will do it very cheap or free.

105. Check out 100 more tips here!

Related Posts:

3 Money Saving Challenges You Need To Start TODAY!

10 Insanely Smart Ways to Save Money Fast

Summary

Wow that was a long list! I hope you have found some little ways to save money every day! I realize you may not do all of them but try to do some from time to time! It will add up over time and save you money!

You do not have to do all of these things or even be extremely frugal to save money each month.

These little frugal living tips can add up to a lot of money each month.

That way you can do the things you want with the money that you save!

I agree, even just making a budget can really help you save. Sometimes when we don’t take a look at our finances, it makes it difficult to realize that you’re actually overspending..

Awesome practical list! Its amazing how much you can save by making little changes. Packing lunches is huge! Also, we became very DIY with home improvements and that saved us a small fortune.

These are brilliant tips, not only for those trying to live a frugal life but for those in a tight budget(like me) really appreciate you sharing, these tips will come handy when the month seem to have 10 days more than usual before payday.

Love these practical money-saving tips. The cool thing is you can pick just a few to get started and add more and more depending on how much money you want to save for other things. The library is a big way to save money for my family. Free books, movies, activities and more every week!

These are all really good tips! You’re so right about cooking. It can save you a lot of money. I definitely need to work on that. Also, thanks for the coupon website! Super helpful!!

Thanks for the tips! I use an envelope system, so I love reading about frugal living. 🙂 these are great! Keep it up!

Great tips for living frugally. I especially like number 1 as it’s my realm. When you plan your meals in advance you save on the shopping and you can get a good idea of how you can repurpose the leftovers. 🙂

Packing lunch for my husband was huge. One of the bills we cut out was cable. I thought it would be a problem but Hulu and Netflix are so terrific that it was fine and a better deal. Meal planning is something I need to work on. Thank you. Rachel from https://www.explorekidtalk.com/

Amazing! ideas i have totally frugal with this tips thanks for sharing.

Love the tips! Especially prevalent in the computer era! The only one I had an issue with was getting rid of the landline. Yes, it’s a savings – if you live in an urban area with reliable cell service. Please keep your landline in spotty service areas for emergency use if nothing else! I look at it as an insurance policy.

You are exactly right!