I want you to imagine a world where you could not stress about how to pay for things like Christmas and birthdays.

You already have the money saved and are able to pay for the gifts without swiping a credit card.

How stress free would that be?

This is where sinking funds come in to the picture.

I usually get some weird looks when I mention sinking funds and how they will save your sanity and your budget.

Most of the time, people have no clue what I am even talking about.

I will explain what a sinking fund is in simple terms and let you know how to use them to stick to your budget and save your sanity.

Sinking funds will save your budget and lower your stress level for all those things that come up and you don’t know how to pay for them.

In this article you will learn:

- What is a sinking fund

- What are the benefits to using the sinking fund method

- Sinking fund categories you should use

- How it all works

- Where you should save these funds

- The difference between sinking funds and emergency savings

- Grab your free sinking fund excel spreadsheet

What is a Sinking Fund?

The technical definition of a “sinking fund” is a fund formed by periodically setting aside money for the gradual repayment of a debt or replacement of a wasting asset.

Ok, if you’re still with me and have no clue what you just read, take a deep breathe and realize you are not alone.

Let me explain that in real person terms lol!

A sinking fund is simply a saving for things that don’t come up every single month.

Sinking funds should simplify your budget and life so don’t overcomplicate it.

A sinking fund is not an emergency fund. I will explain later the difference but for now, know they are not the same thing.

Sinking funds are for things that don’t come up every month but you still need to plan for them. Things like:

- Birthdays

- Christmas

- Holidays

- Vacation

Imagine going on a paid for vacation and coming home and not worrying about the credit card bill that is coming. That is what sinking funds can do for you!

What is the Sinking Fund Method?

The sinking fund method is saving money for things in your monthly budget that don’t come up every single month.

This method works well because you can save a little bit each month instead of taking a huge chunk out of your budget in one month.

It also saves you from trying to decide what bill to pay when the unexpected comes up. This way you don’t have to think about what bill will be late so you can pay for the flat tire to get to work.

You can do it a couple of different ways.

You can take the amount needed in a year and divide it by 12 and then save that amount each month.

Or You can also save chunks at a time until you hit your goal.

It just depends on your budget and goals and which way you prefer.

This method works best alongside a zero-based budget. A zero-based budget is simply planning for every dollar in your budget.

This makes it easier to plan for sinking funds in your budget.

Benefits of using sinking funds

Sinking funds will help you manage your money better.

It will help you plan for those things that you forget and that always seem to wreck your budget.

When you have the money for things already saved, then they no longer become emergencies.

You get to not stress about how you are going to pay for it!

Another benefit of sinking funds is that if you find a great deal, you can go ahead and pay cash for it!

You can also get a great deal by being in a position to negotiate with cash.

I was able to save hundreds of dollars on our new HVAC system by paying with cash. It saves small businesses transaction fees by paying in cash. They can also negotiate better with their suppliers or subcontractors by paying them in cash also.

Plus when you can pay for something before it becomes a true emergency, then you can shop around and find the best deal.

We knew our HVAC system needed replaced and we were able to pay for it before it completely quit and we would be desperate for a fix.

This got us a better deal and saved us hundreds of dollars.

Can you imagine paying for Christmas through out the year by finding great deals and not stressing about last minutes shopping?

Or even better, not stressing about the credit card bills coming in January!

You can have it all paid for in advance and not stress about the money.

These funds also allow you to plan for your money while saving and paying off debt. It goes along with using cash envelopes and saving for emergencies.

That is what a budget and sinking funds can do for you!

- Save for just about anything and pay for it with cash so you can avoid debt. You can make a sinking fund for anything you want.

- You get to do what you want without the guilt! When you pay for things ahead of time and with cash, you don’t have to feel guilty afterwards about how you will pay for it.

- Reduce the stress of credit card debt! When you plan for things and can pay for them with cash, you get to avoid debt! This will reduce your stress around money since you will have a plan for everything.

Sinking Fund Categories

Sinking funds should be used for categories that you can not cashflow in the month they are due.

So, if you don’t have a lot of room in your budget every month, this is the perfect way to save for those things that you usually scramble to figure out how to pay for it.

Sinking fund categories examples:

- Christmas

- Taxes

- Vehicle maintenance or repairs

- House maintenance or repairs

- Kid activities/sports

- Clothing

- Gifts

- Birthdays

- Holidays

- Insurance deductibles

- Yard maintenance

- Quarterly or Yearly bills

- Taxes

Your categories will depend on your budget and your lifestyle but overall you should consider these categories in your budget.

Related posts:

- 12 Monthly Budget Busters List of Unexpected Expenses

- Budgeting for Beginners: A Step-by-Step Guide

- 100+ Budget Categories You Should Plan For

Things to think about when planning for sinking funds:

- What big planned expenses do you have coming up? This could include vacation, Christmas, vehicle maintenance or new tires, replacing your washer and dryer and things like that.

- What are things that are constantly coming up that you forgot in your budget? Things like: kid activities and sports fees, birthdays and holidays, seasonal expenses like snow removal, cold and flu medicine and things like that.

- General funds for “unexpected” expenses that you need to plan for. Things like: house repairs, replacing appliances unexpectedly, insurance deductibles and things like that.

A good way to plan your sinking funds is to think about things that you want or need to pay for through the year.

Then figure out if you need to save for it or if you can fit into your budget in the month it comes up.

When you make your monthly budget, put the amount you need to save in each month.

Personally, I like to have a minimalist budget and don’t like a lot of little things coming out every month. So, I save big chunks for one thing at a time. Once I meet my goal for that fund, I move to the next.

It will depend on what you prefer and what your budget allows you to do.

How it all works

Let’s use a real life example so you can see how this will work.

After your regular monthly expenses, you have $550 left over to apply toward sinking funds.

You know you need to save for the following items for the year:

- $800 for Christmas

- $500 for birthdays

- $1200 for car repairs

- $1000 for vacation

- $1500 for medical expenses

In your monthly budget you will need to save in sinking funds:

- $67 for Christmas

- $42 for birthdays

- $100 for car repairs

- $83 for vacation

- $125 for medical expenses

That leaves you with another $133 to plan for in other funds. You can save in a general house or vehicle maintenance fund or add more to another fund.

Another ways to save for these funds could be to focus on one savings goal at a time.

If you want to save $800 for Christmas, you would save $550 the first month. The second month you would save $250 for Christmas and $300 for birthdays. The third month you would save $200 for birthdays and $350 for car repairs.

I prefer this method because it fills the fund quickly in case you need to use it sooner than expected. It also keeps your budget from being overly complicated every single month.

It’s really up to you and your personal preference.

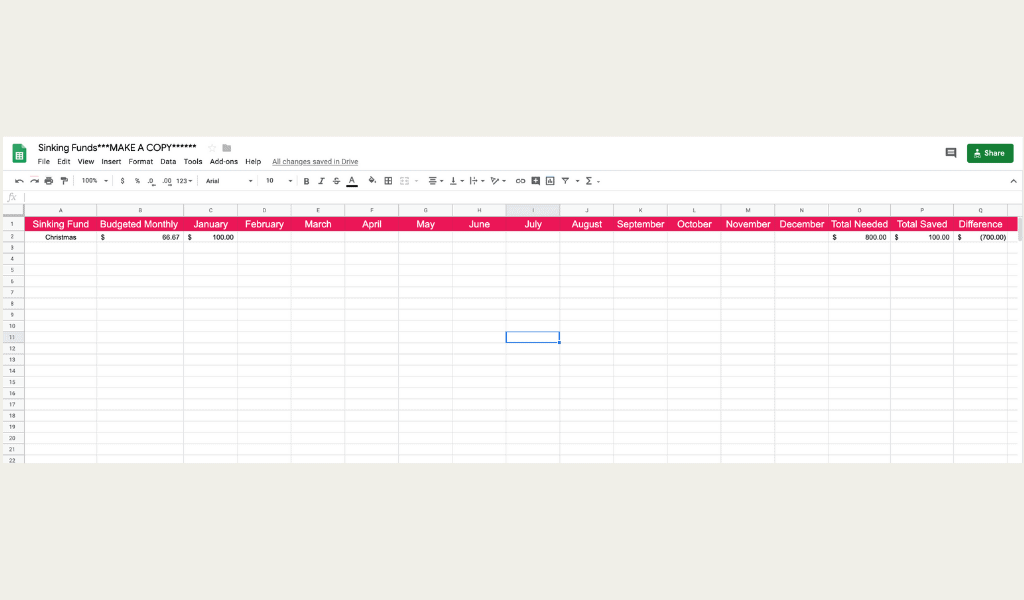

GRAB YOUR SINKING FUNDS EXCEL SPREADSHEET:

Where should I save these funds?

It is so important for you to save these funds somewhere you won’t “accidentally” spend it on other things.

There are a couple ways you can do this:

- use one savings account

- use a different bank from regular checking account

- cash envelopes

- one savings account with a spreadsheet tracker

- multiple savings accounts with one for each fund

I use combination of methods. I use cash envelopes for some and I have an online bank that is separate from my regular bank that I have a separate account for each fund.

It’s really about finding what way works best for you. It’s important that no matter what you do, put it in a separate account and where you won’t be tempted to spend it.

If you use multiple bank accounts, label each one online so you know which account is for which fund.

CIT Bank is a great bank to use and they have a high interest savings account. Right now it’s at 2.30% APR for their savings builder account.

Sinking Fund vs. Emergency Savings

It’s important to note that your sinking funds are not the same as your emergency savings funds.

Your sinking funds are for expected expenses that you need to plan for.

Your emergency savings, is for unexpected emergencies. It is important to keep them separate and not rely on your emergency savings to fund expected expenses.

Sinking funds are things that you should be planning for so you need to budget accordingly.

Summary:

Using sinking funds will help you stay on track with your budget and reduce the amount of things that just “pop” up that you didn’t think about.

You will be able to save money and reduce your stress when things come up.

Planning for these things whether it’s month to month or large chunks at a time will help save your sanity and allow you to stop living paycheck to paycheck!

Imagine being able to pay cash for repairs, Christmas, and even birthdays! Even while you are saving for emergencies or paying off debt.

Sinking funds make it all possible!