Creating a financial plan that can stand the test of time is crucial if you want to financial peace.

Peace when there is a global pandemic.

Peace when there is a global recession.

Peace knowing that your family will be taken care of in the short-term while this all gets figured out.

It’s scary right now and the fear of the unknown can be paralyzing.

It’s important to remember that this is a short-term problem.

We may not know what comes after the dust settles but we will make it through this.

The longer short-term financial effects are unknown at this time.

However, there are things you can do now to prepare for the short-term and for in the future for when a recession or crisis happens again.

In this article, you will learn:

- How to prepare your finances for a recession

- Things you can do while in crisis mode

- Ways to prepare your finances in the long-term

Preparing Your Finances For a Recession

Treasury Secretary Steven Mnuchin has warned that we could see 20% unemployment rate during this financial crisis.

If you are already feeling the effects of this crisis, you may be thinking, “there’s no way I can do anything now, it’s too late”.

There are some things you can still do right now even while we are in the midst of a global crisis.

You can lay the foundation for when you do get income coming in whether it’s from the government or a job.

If you can lay a solid foundation now, when the next recession does come, you will be prepared for it.

Recessions are a normal cycle for the economy. We have been fortunate that we had a long run of a great economy before this crisis hit.

It is unknown officially if we will go into a recession once the dust settles, but it appears to be very clear that we will. I am not an economist but with so many people and businesses being out of work for up to 2 months, it seems unavoidable.

Our economy depends on people being out and spending money. If the majority of the population is at home, a lot without a paycheck, and unable to spend money, it will be felt by the whole economy.

So, whether we are immediately headed toward a recession or not, it’s still wise to prepare for the next recession because there will be another one eventually even if this is not the time.

Make a budget

The first thing to do when preparing your finances, is to make your budget.

I know it’s not what you might want to do right now, but it is the foundation for everything else.

Once you get it set up though, it’s super quick and easy to create one for each month.

Here is a FREE Step-by-Step Budgeting Guide:

If you prefer step-by-step videos, check out the 7 Day Budget Challenge!

Creating a zero-based budget is crucial when you are wanting to be intentional with your finances and reach your bigger money goals.

This is an important step when preparing for a recession.

When you set up an intentional budget plan, it makes it super easy to save money and pay off debt while ending mindless spending.

*If you are currently unemployed, you should still prepare a budget.

You will create a prioritized budget by listing out all of your expenses in order of priority.

In any budget, you should list out your expenses in order of priority.

Items that should be first in your budget:

- Food

- Housing costs

- Transportation

- Clothing (if needed)

These items come before debt and any extras. Now, even still there are priorities within those categories as well.

Just because I have food at the top doesn’t mean you should eat out every single day.

Same goes for housing, transportation, and clothing. Just because it’s a priority doesn’t mean that you need a minimansion, to drive a luxury car, and wear designer clothes, if you are broke.

If you can afford those things and you want to do that, that’s fine.

However, if you are unemployed or preparing for a recession, those are things you will have to decide are important to you.

In the grand scheme of things, would you rather save for retirement or drive a Mercedes? Pay for gymnastics for your kid or save for their college?

Life is all about priorities.

Your spending shows what is important to you.

So, if you are frustrated because you want to save for things like: building a house, retirement, emergencies, ect., then examine where your money is going.

Examine Spending and Expenses

This is a very eye-opening step and the one we avoid the most.

This is so important when preparing for a job loss or recession and really when creating your budget at any time.

In order to make the biggest changes, you have to examine your spending.

For most people the biggest category besides housing and the biggest waste of their money is on food.

It’s so easy to drive through and get food, go out to restaurants and order take out. Especially as a busy family.

However, if you are preparing for a financial downturn, this is the first area to examine.

Then just like prioritizing your budget, you need to prioritize your spending.

Determine Needs Vs. Wants

When you are examining your budget and expenses and preparing for a financial crisis, it’s important to determine what are really wants and what are needs.

If your family has no income, you have to cut wants from your budget. You also have to make sure your basic needs are met.

When hard times come, you may not have money for any wants so if you can mentally prepare ahead of time, it will lessen your stress.

Most of our stress comes from the unknown. A lot of that feeling causes us to just ignore our finances and hope for the best.

It does actually help you stress less if you have a plan in place because you will know what to do.

So, make a list of what are needs and what are wants.

Then determine if I lose my job what will have to be cut and what will have to be paid.

If you can mentally prepare ahead of time, you won’t panic when it does happen.

Save 3-6 months of expenses

Normally I advocate saving a small amount then paying off debt.

However, when you are in the midst of a crisis or preparing for a job loss, you need more than even $1000 saved.

During a recession, it can be hard to find a job for a longer period of time.

Saving up to 6 months of expenses can help you transition during this time.

Plus unemployement does not cover 100% of your lost income.

So, even if you get unemployment, you will still need to make up the difference if you keep your lifestyle the same.

If you are preparing for a recession or job loss: SAVE SAVE SAVE!

Even small amounts add up over time. If you can save $10 here and $20 there, it will add up.

You can even do monthly saving challenges to help motivate you to save money and not spend it.

Create a Stockpile

At the time that I am writing this, everyone panicked and wiped out stores all across the country.

I saw this crisis coming a month before and stocked up my pantry, freezer, and household supplies.

I usually keep a stockpile anyway but it had been wiped out this winter from months of nonstop sickness in my house.

I think it is important to keep at least a month of supplies and food on hand.

After experiencing this crisis, I will be building a 2-3 month supply once this is over.

There are people that are struggling during this crisis because they were low on food and couldn’t get anymore until payday.

When they did get paid, the stores were mostly empty.

So, if you already have a stockpile in place, you don’t have to panic shop and wipe it all out for those that do actually need it.

If you are preparing for a recession, if you are low on income, you can make your supply last to help get your family through.

You may not be able to stock up at the time that I am writing this but this is something that you should prepare for in the future.

There are some easy ways to do this overtime so that you don’t spend a crazy amount of groceries all at once.

When creating a stockpile you can:

- Buy in bulk and freeze

- Double meals and freeze

- Keep staples on hand like flour, sugar, canned food, rice and beans

- Freeze leftovers

- Stock up when finding great deals

- Buy one, save one

When you are shopping, you can buy an extra pack of meat and divide and freeze it.

You can buy an extra bag of flour, sugar, and other baking needs.

If you need one jar of spagetti sauce, buy two or three.

As you use what you need, keep replenishing as you go so you don’t use your stockpile.

You can also freeze tons of meals. You can make a double batch of a meal and freeze the extra.

I like to freeze lasagna, chili, chicken and noodles, creamy chicken penne, beans, broth, spaghetti sauce, and so much more.

You can also easily freeze leftovers.

When you are mindful of the resources you have, you will waste less.

Paying Off Debt

I am a huge advocate of paying off debt. My family paid off $45,000 in 17 months even.

I think it is important to do it fast so you can save more and be better prepared for a job loss or loss of income.

However, when the crisis is imminent and near, you should focus on saving, not paying off debt.

When times are good and you have steady income, then focus on paying off debt as fast as possible.

This will lessen your stress when you don’t have to worry about paying so many bills.

All you have to worry about is keeping a roof over your head and food in your bellies, which is stressful enough.

Do Not Try to Time the Market

I am not a financial advisor, so please talk to one about your investments on a regular basis, not just in times of panic.

What I do what to stress to you is to not try to time the market.

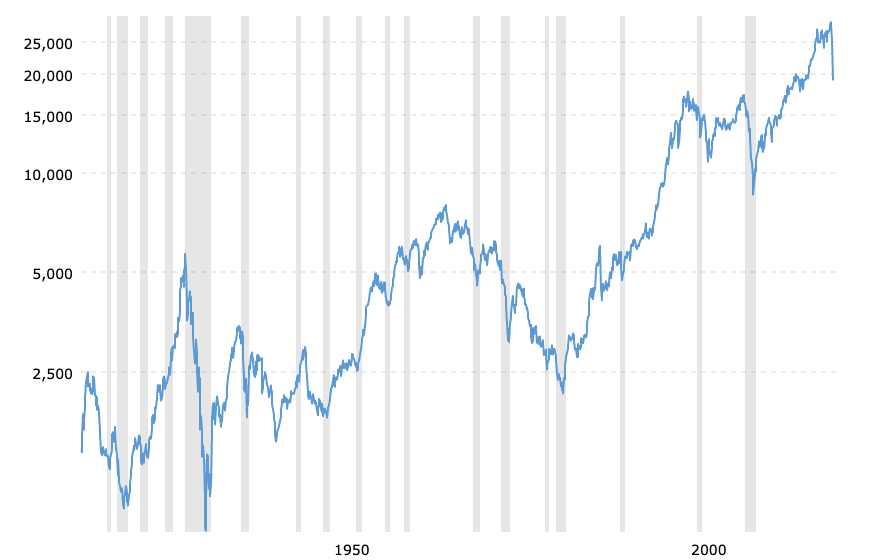

Historically, there are always ups and downs.

Dow Jones – DJIA – 100 Year Historical Chart

If the market is already in a freefall or downturn, do not sell just because of that.

The economy will recover in the long-term. We are investing for the long-term, not the short-term.

Do not let the short-term news and events effect your long-term investing strategy.

Do not wipe out your 401(k) or sell everything because you are stressed.

If you need to make adjusts to your investments, talk to your financial advisor.

Summary

Remember that recessions, job losses, financial crisises are all temporary.

You will get through this. Recessions happen and job losses happen, and if you are prepared ahead of time, you can mitigate a lot of the short-term issues before they even happen.

If you are prepared mentally and financially, it will make it less stressful and help get you through it.

Keep your head up and make your plan for the future. It won’t be like this forever.