It is my mission to inspire you to pay off your debt by providing success stories and simple tips to get you there. I was able to pay off $45,000 worth of debt in 17 months and then started helping others pay off their debt fast also. The biggest hurdle in paying off debt is really just believing that you can. That is genuinely the first step. Once you believe that you can, the rest is figuring out how to get there. Let’s take a look at how Ketuan paid off $90,000.

Debt Pay Off Story – Ketuan

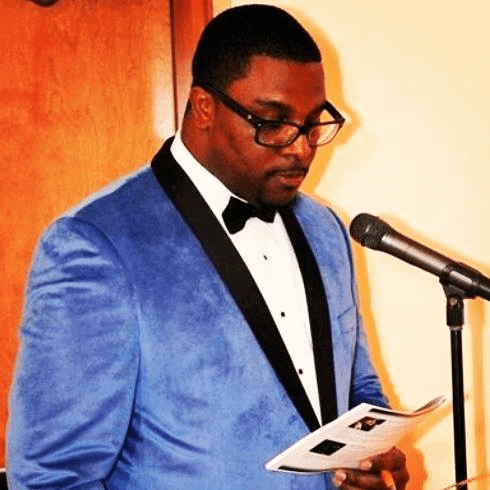

My next debt pay-off success story comes from Ketuan. He is a single father of 2 little girls and was able to pay off $90,000 in 3 years! His current goal is to become a millionaire, and he is on his way to reaching it. He is changing his family tree and building a legacy for his children.

I connected with Ketuan after seeing a post he made in Chris Hogan’s Everyday Millionaire group. He made a post celebrating how is paid off his mortgage 3 years! Once I saw his story, I knew I wanted to share it with you.

This is what he shared when he paid off his mortgage debt 3 years ago.

In 2008 at the Age of 24 I set out on a journey to purchase a Home. I wasn’t sure if I could afford it because I was super young and didn’t have truly stable employment. I still went out on faith and took on the commitment to purchase this home. Making the 30 Year commitment was scary but God had favor on my life and allowed me to pay-off my home 23 years earlier than scheduled. Wow, what a blessing!

This truly aligns to my favorite scripture, ” But seek ye first the kingdomof God, and his righteousness; and all these things shall be added unto you.” Matthew 6:33

Now I’m completely Debt Free because I took action believing that “the borrower is slave to the lender” Proverbs 22:7.

Yes it took hard work and many sacrifices but it was well worth the efforts.

When you believe something is possible, you can do anything. If you believe you can be debt-free, you can. Here is Ketuan’s story about becoming debt-free and how his life has changed.

This post may contain affiliate links. For more info, see my Disclaimer and Privacy Policy.

Related posts:

How One Couple Paid off $70,000 in 12 Months!

How Ketuan Paid Off $90,000

Tell us about yourself

I’m a single Father of two girls. I have an associate’s and bachelor’s degree in Computer Information Systems, along with a Master’s in Business Administration.

How much debt did you have before? How quickly did you pay it off?

I had a little over $90,000 in debt. It took me about 3 years once I was committed to the journey, but I paid off my mortgage in those three years.

What did you do to pay it off?

I paid off my credit cards, car, student loans, and my home. My income increased after completing graduate school. I made the commitment to put the increased income toward debt and kept my living cost modest. I cut out vacations completely, cut back on dining out, and found free or inexpensive entertainment.

What are your current financial goals? And why

Currently, I have a financial goal of one million dollars in net worth. Without any debt, there is a much easier path toward this goal. I have this goal to prove to myself and others that it can be done through long-term commitment without a sports contract or hitting the lottery.

What was your “aha” moment that caused you to change your financial ways?

I think the “aha” moment for me was one of Dave Ramsey’s examples of paying cash for a car. It stuck with me on being on the right side of the interest equation. Either you will be paying interest, or you can be on the opposite side of the tracks and earn interest.

Who has been a major influence on your financial decisions?

Being a father and wanting to develop generational wealth. My children have been the biggest influence on me to become a better and more responsible steward of the money I earn.

Look at the bigger picture in life and never worry about what people will think!

Do you do a monthly budget? Any tips for sticking to it?

Yes, I have a budget that is led by paying myself first. I always have a portion of my income that will go into my 401k, saving, and other investment before I consider other financial commitments. This was difficult at first, but once I was debt free and paid off my mortgage debt, it is now a piece of cake.

Get your FREE budget worksheet

Learn how to budget for people who suck at budgeting! Get all my tips and advice and printable to help you get started!

Do you read nonfiction books regularly? What are your favorites?

Yes, I read regularly. I love to learn new things and ideas.

My favorite books are:

- 7 Habits of Highly Effective People,

- Automatic Millionaire,

- Shift Your Brilliance and

- The Total Money Makeover

How do you stay motivated?

I try my best to surround myself with people who have extreme goals as well. Whether those goals be financial, community, or career-related. We push each other to stay committed and achieve greatness. I also took a moment to self-reflect often and learned from things that I have gone through, whether it’s good or bad.

If you could go back in time, what would you tell yourself?

Look at the bigger picture in life and never worry about what people will think about what type of car you drive or how you dress. The debt involved is never worth trying to impress others.

What is your biggest financial struggle? What do you do to combat that?

For me, I think my biggest struggle now is being patient. Today my goals are aligned I know it is just a matter of time before I reach my goal. But when I had debt, my biggest struggle was big purchases like buying a car I didn’t need.

What advice would you give someone in your situation?

“Think beyond today and structure your lifestyle with the idea of having flexibility and options tomorrow. “ ~Ketuan

Sometimes people have aspirations of starting a business or going in a new direction in their career, but they soon give up on new dreams because the debt limits their ability to do something new because they have no flexibility beyond the next paycheck.

Today, Ketuan is an App Development Manager for a major technology firm. In his free time, he loves volunteering, mentoring, and collaborating on new opportunities for people. He is a dedicated father of two girls.

You can follow Ketuan on Instagram or Twitter.