The debt snowball method is a cornerstone of Dave Ramsey’s plan and part of the foundation to building long-term wealth.

I first discovered the idea of the debt snowball when I was deeply in debt and searching for ways to pay it off fast.

I found myself in a situation where we owed thousands of dollars to the IRS for a 401(k) loan when my husband lost his job.

I put what we owed onto a zero-percent interest credit card and then realized I had no clue how I would pay it off in 18 months.

I started searching for ways to pay it off fast and found Dave Ramsey and the debt snowball.

My life changed forever after that as we ended up paying off all of our consumer debt, $45,000, in just 17 months!

It all was possible because of a solid plan and the debt snowball.

I get asked a lot about the debt snowball and if it’s better than other plans, so I wanted to explain why it works and how it differs from other methods.

In this article you will learn:

- What is the debt snowball

- How does the debt snowball method work

- Pros and cons of using the debt snowball

- Is it the best method

- Exceptions to the debt snowball method

- The debt snowball vs debt avalanche method

- Should you pay off higher interest loans first

- Why you should use a debt snowball calculator

- Is it better to pay off debt or save money

- Tips for paying off debt fast

What is the Debt Snowball?

The debt snowball method is a debt pay off method that consists of paying off your debts from smallest to largest.

It does not take into account interest rates or other factors for your situation.

It is the debt pay off method preferred by Dave Ramsey and his plan.

In the Dave Ramsey plan, it is Baby Step 2. It comes after saving a $1000 baby emergency fund. Once you have Baby Step 1 completed, you move to the debt snowball.

How does the debt snowball method work?

- List out all your debts

- Put them all in order from smallest balance to largest balance

- Put all extra money toward the smallest debt

- Pay minimums on everything else

- When smallest is paid off, roll that payment and extra money to the next smallest debt

- When you get to the largest debt, you will have all minimum payments and extra money to do towards that one debt

- Focus on one debt at a time

- Find extra money

In order to follow this debt pay off method, you have to list all your debts from the smallest balance to the largest balance.

This method does not take into account interest rates unless you have two very close balances.

Once you have the balances listed out from smallest to largest, you focus all your money on the smallest debt.

This works best with a zero-based budget so that you are intentional with every single dollar. All extra money does toward one debt at a time while paying the minimum payments on everything else.

Once you have the smallest balance paid off, you take that minimum payment and all extra money and out it toward the next smallest debt.

Once you get to your largest debt, you will have all the minimum payments and all the extra money to put toward that debt.

Pros

There are more pros than cons to this method which makes it extremely effective. The cons are minimal and don’t outweigh the pros of this method.

The pros of using this method include:

- It’s incredibly motivating to get the quick wins and see progress

- You focus on one debt at a time

- It’s a proven effective method to pay off debt

- It frees up extra money as you pay things off

The pros of the debt snowball method make it the ideal method to pay off debt fast. If paying off debt were completely based on math, this wouldn’t be the best way.

However, managing debt is about psychology not math which makes this method ideal.

Cons

The cons of using this method include

- You may pay more in interest depending on your situation

- It may take you a little longer to pay off all your debt

- It may not be the best method depending on your situation

In reality, you can use a combination of methods as long as you make progress quickly and are intentional with your money.

Is the debt snowball the best debt pay off method?

The debt snowball method is incredibly effective because it keeps you motivated to keep going. You get the quick wins of paying off a debt fast and it will inspire you to keep going and do it faster.

In reality if you are being intentional with your money and trying to pay off your debt as fast as possible, the interest rates won’t matter that much.

You won’t be in debt long enough for it to make that big of a difference.

This method works best for most people, however there are a few exceptions.

When is the debt snowball methods not the best option?

This debt pay off method works best for most people in most situations however, there are a few instances where going out of order may be the wisest thing to do.

For example, if you are short in your budget $300 every month and need to pay something off to avoid more debt, then go out of order. Pay off what you can to free up the money in the budget instead of worrying about the balance. This will help you avoid going into further debt.

Other times that you will want to go out of order include paying off the IRS and/or payday loans. Those should be the highest priority for paying off debts even if there are smaller balances.

The thing is, when you are intentional about your money, it will all happen eventually. The point of the debt snowball is to keep you motivated to keep going when times get tough.

If it’s going to take you 3 years to pay off one balance, you will give up.

I was able to pay off $45,000 in 17 months because of how motivating this method is.

If you try to focus on the bigger balances first, it will be very hard to stay the course when times get tough.

Debt snowball vs avalanche

The debt snowball method only focuses on the debt balance.

The debt avalanche method focuses on the highest interest rate.

Both methods have you focus on one debt at a time. Studies have shown that the debt avalanche method pays things off quicker but that the debt snowball is more effective.

The issue here is psychology and how our brains work. If it were all about math, we wouldn’t be in debt in the first place.

The debt avalanche method will save you some money over time, but that doesn’t matter if you give up and never pay the debts off.

The debt snowball is the best method but for the vast majority of people but like I mentioned above, there are instances to do other methods first. However, once the priority debts are taken care of, you should go back to the snowball method.

One example of when the debt avalanche may be the best approach is if you have a high interest rate loan and can pay it off fairly quickly by changing the order.

If you can knock out a high interest (25%+) loan instead of paying off a medical bill at 0% then do that. But only do that if you can do it within a few months. If it takes you one month to pay off the medical bill and 6 months to pay off the high interest loan, pay off the medical bill.

Don’t make it too complicated, keep it simple and follow the plan.

You need to get the quick win for the motivation.

This is why the debt snowball method works. Paying off debt is about changing behavior not math.

In order to get out of debt and stay out, you have to change your mindset and habits. This is where the debt snowball is the most effective.

Shouldn’t I pay off higher interest rate loans first?

Paying the highest interest rate first would seem like the most logical way to do it but it is not the most effective.

Using the debt snowball method is more effective than focusing on just the interest rate.

When you focus on paying off the smallest debts, it helps you change your mindset and helps motivate you.

You are more motivated when you can visually see your progress. This is why I highly recommend making a visual of your debt pay off progress.

It can feel like you aren’t making progress even when you really are. When you can visually see your progress it helps motivate you to keep going.

This is why the snowball is more effective than the avalanche method.

You are more likely to finish paying off debt when you pay off the smaller balances first versus focusing on interest rates.

Why you should use a debt snowball calculator

Using a debt snowball calculator is really beneficial no matter what method you choose.

Using a calculator allows you to visually see how fast you could pay off all your consumer debt. It also allows you to play around with the numbers.

What I liked to do was to make a game of it. I would see how fast I could pay it off with $x amount each month. Or a lump sum one month and see the difference in dates.

What is great about using a debt snowball calculator is it will configure all your debts and their individual dates in order for you.

It makes it so easy to make a written goal for yourself. Studies have shown that writing down a goal and visualizing it makes it 1.5 times more likely that you will achieve it.

So using a calculator and playing around with the numbers to see how fast you really can achieve your goals, will help you actually achieve your goals.

Debt Snowball Spreadsheet

Using a debt snowball spreadsheet is a simple and easy way to track all your debts and your progress.

Visualizing and totaling all your debts will likely be extremely eye-opening. If you are normal, you don’t even realize how much debt you actually have.

When I did it the first time, I was shocked. I only had 3 debts but it totaled $45,000! I thought we were doing fine but that huge number was eye-opening.

Using a spreadsheet will help you track which debt to focus on and easily see your totals. This will help you see how much you have paid off and how much you have left.

GRAB YOUR FREE DEBT SNOWBALL SPREADSHEET HERE:

Debt Snowball Worksheet

If you prefer to track your debt snowball on a worksheet, I have a FREE DEBT SNOWBALL WORKSHEET as well.

Doing it on a worksheet helps your brain process the information better and you are more likely to achieve your goals if you write it out.

Using the worksheet also makes it easier to put in your budget planner and track your progress each month.

GRAB YOUR FREE DEBT SNOWBALL WORKSHEET HERE:

Is it better to pay off debt or save money?

This is a great question and the answer depends on a couple factors.

Dave Ramsey recommends saving a small $1000 emergency fund before paying off debt. However, depending on your situation, you may need more than that.

He recommends only $1000 because it will help you avoid debt in a lot of minor “emergencies”. It also keeps you motivated to pay off debt really fast because you don’t have a large safety net if something happens.

There are a few exceptions to this though. You will need to only focus on saving money if any of these apply to you.

- You are pregnant

- You are expecting a job loss

- You are planning a move

- You are expecting major home or vehicle repairs

- You or a family member have major medical issues

If ANY of these apply to you, you focus on saving money until that exception has passed.

If NONE of those apply to you, you save a small emergency fund and then focus on paying off debt.

Once you are debt-free (except the mortgage) then you save your full emergency fund of 3-6 months.

Then you will have money to invest and live the life you really want!

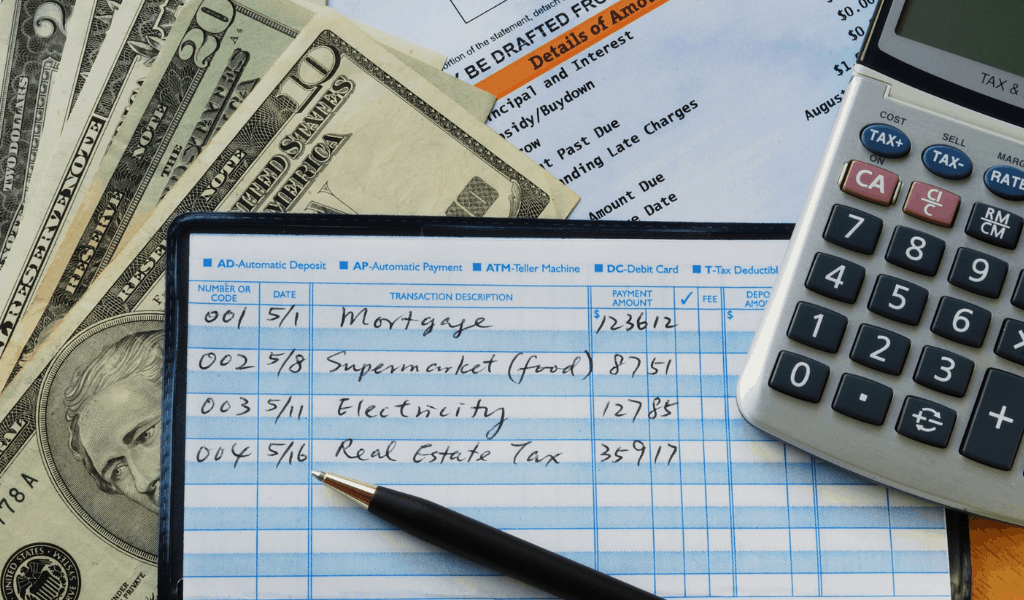

Debt Pay Off Tips

You may be reading this and thinking, that’s all great but I can’t pay off debt that fast.

Let me tell you something, I didn’t think I could either.

I was panicking searching for debt pay off plans because I didn’t think I could pay off $6000 in 18 months. It wasn’t until I did a zero-based budget that I realized I could do it and much much faster than that.

I ended up paying off that $6000 in less than 3 months.

I used these debt pay off tips to do it fast!

- Make a zero-based budget

- Track expenses

- Cut expenses

- Save money where possible

- Do a no-spend challenge

- Sell anything and everything

- Work extra

- Get your spouse on board

There is at least 2 or more things on that list that you can do. It’s all about your mindset. If you believe you can do something, you are halfway there.

If you don’t believe me, do a zero-based budget and then start playing with the numbers in the debt snowball calculator. If will surprise you I’m sure.

When you start tracking your expenses and seeing where your money has been going, it is eye opening. This will help you change your mindset and see where you can save money.

Summary:

The debt snowball is the most effective way to pay off debt for the majority of people.

As I stated above, there are some exceptions that need to be considered for some people.

This debt pay off method is effective at changing behavior and actually becoming debt-free.

If you only focus on the interest rate, you may not stay motivated long enough to make fast enough progress.

Dealing with debt is not a math problem, it is a psychological problem. If you were good at math, you wouldn’t be in debt and looking for debt payoff plans.

No matter which method you choose though, the important thing is that you make a plan and do it.