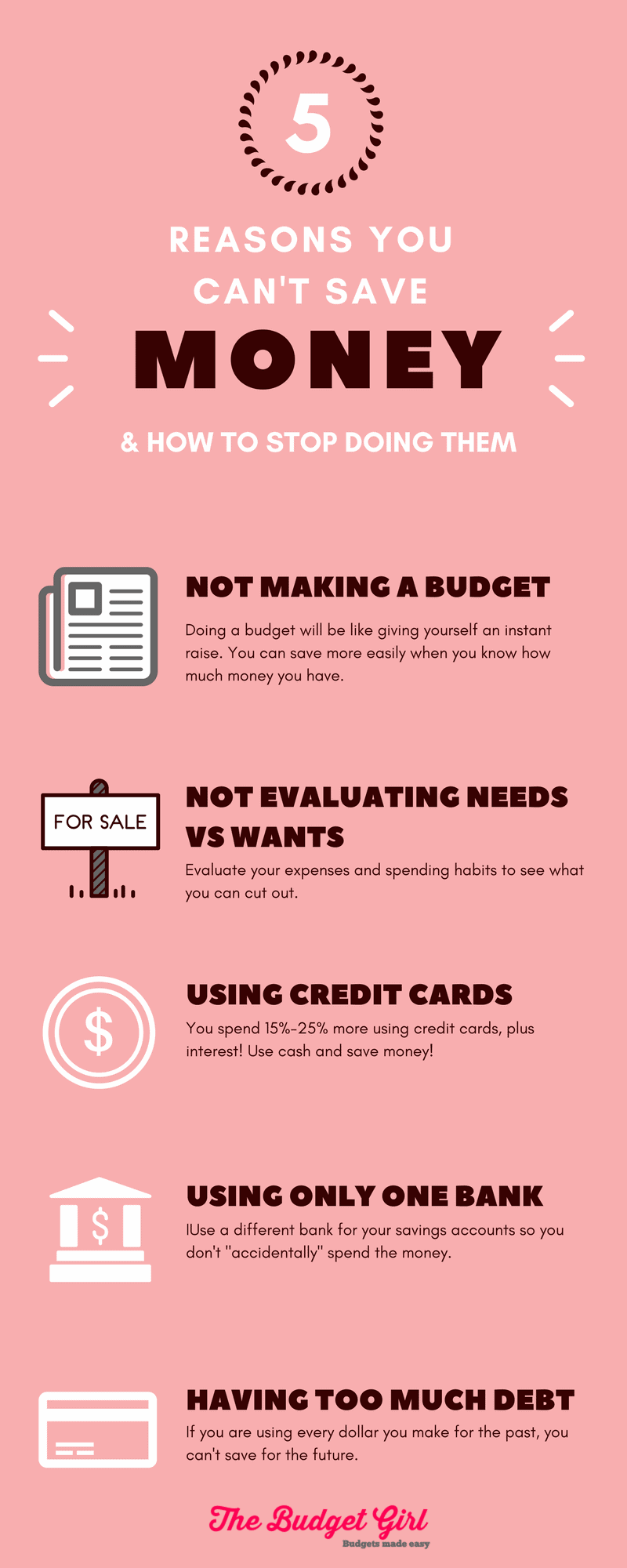

5 Reasons You Can’t Save Money

Are you lost and confused why you can’t seem to save any money? Saving money can be hard but it doesn’t have to be. If you take some simple steps, you can make saving money so much easier! Here are 5 reasons you can’t save money and how to STOP doing them!

Not Making a Budget

The most beneficial and basic step for your finances is doing a budget. When you do a budget, you feel like you got a RAISE! I have heard this over and over and felt it myself. When you aren’t telling your money where to go, you wonder where it went. When you start telling it where to go, it feel like you have more of it.

When you make your budget, you can save money more easily because you can see where your money is going.

Get your FREE budget worksheet here:

How to Make a Budget and Stick to It!

5 Sensible Budgeting Tips From a Money Saving Mom

Not Evaluating Needs Vs. Wants

When you are wanting to save money, you have to evaluate expenses. You can’t save money if you are spending frivolously. Do you go to Starbucks everyday? Are you eating out several times a week? Do you have 250+ TV channels?

I want you to track your expenses for one month and categorize them as a need or a want. If you want to save money, you will have to cut out some wants. You will have to stop eating out everyday. Some other ways to save a ton is by meal planning.

I saved $600 a month by cutting out fast food and changing the way I grocery shop.

Using Credit Cards

You can’t save money when you are still using credit cards. You spend over 20% when paying with a credit card versus paying with cash. When using a credit card, it doesn’t have the same feeling as paying with cash. If you want to save money, use cash.

Not to mention the interest rates if you aren’t paying it off every month!

Related Posts

How to Save Money in 5 Easy Steps

5 Saving Money Tips You Have To Try Today!

Using Only One Bank

It is so hard to save money when you are using only one bank. You need to use a separate bank for your savings so you don’t “accidentally” spend it. It is so easy to spend it here and there when it can easily be transferred to your checking account. I have 3 different banks and 9 different accounts. My checking account is the only account that I have at that bank. I have 8 different savings accounts, all for a different saving goal.

Having too much debt

Another reason you can’t save money is because you have too much debt! It’s hard to save for the future when your money is being used for the past! Start making more than the minimum payment on the smallest debt in order to pay them off faster. Start using your paycheck for your future goals.

Tips for Paying Off Debt for Millennials!

If you want to save money, it’s time to evaluate where your money is going. You can’t save money if you are spending it like there is no tomorrow. Do you “act your wage” or are you living like you make twice as much money? Start living like you’re broke instead of like you are rich!

Learn how to budget in 3 days!

Plus get my free printables to help you save money every day!