This post is a sponsored post by Qube Money. The opinions are 100% mine.

Budgeting is something almost everyone struggles with at one point or another. For some of us, the difficulty can be chronic. It is frustrating to see yet another month go by without a penny added to your savings.

It doesn’t have to be that way, though! Even if you have failed at budgeting in the past, that doesn’t mean you should give up. It simply means you might need to try something totally new. If you struggle with budgeting, you should consider trying the digital cash envelope system.

No more wondering where your money went each month. It’s time to give your money a job. If you’re ready to transform your finances, please keep reading! We’ll cover everything you need to know about this budget method.

What is The Cash Envelope System

If you have ever heard of Dave Ramsey, you’ve probably heard of the cash envelope system. For those of you who aren’t as familiar with this budget method or who need a refresher, let’s do a quick review.

The basic premise behind the cash envelope system is using a separate envelope filled with cash for each budget category. It is important to note it doesn’t make sense for all categories.

Paying your utilities, your car payment, rent, or other similar expenses with cash isn’t necessary. Plus, since you pay a fixed rate each month there isn’t a possibility of overspending in these areas.

For all other categories, you pay cash from your envelopes. It is especially important for tricky line items where it is easy to overspend. These categories include things such as food, clothing, dining out, entertainment, and so on. Most people who struggle with budgeting will have the hardest time with these categories. For me, the grocery budget is the killer!

For the cash envelope system, here’s what you do. First, add the budgeted amount of cash to the envelope at the beginning of the month or after each paycheck. For example, let’s say you plan to budget $100 for gas. You would add $50 at your first paycheck of the month and $50 with your send paycheck (if you get paid bi-weekly).

Alternatively, if you have enough money in savings, you can put the entire $100 in at the beginning of the month.

Then, throughout the month, you will use the cash envelopes for their corresponding expenses. Once the money is gone, it is gone. This is the trick to staying on budget!

Most experts also recommend not “sharing” money between categories. So, if you have a little extra gas money this month, don’t use it for extra grocery spending. Things will get messy and you will still have the problem of not knowing where your money went.

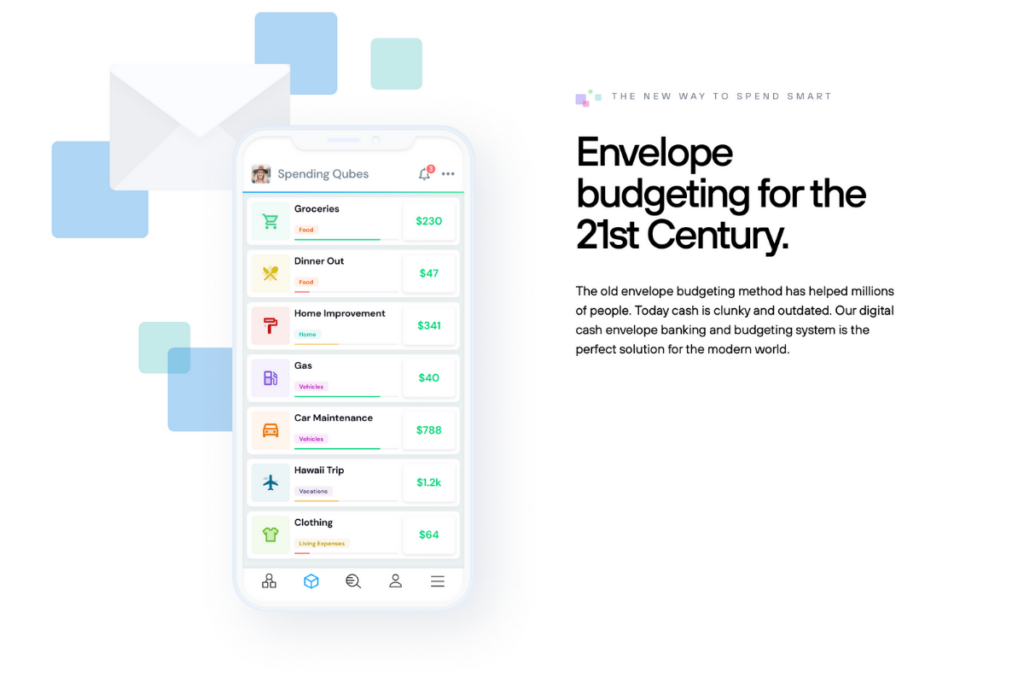

Using a Digital/Cashless Cash Envelope System

Now that you know what the cash envelope system is, you might wonder, why should you use it? And how does it work?

First, using digital cash envelopes is more convenient than actually paying for everything with cash. After all, if you’re anything like me, online shopping is my go-to! Plus, many people worry about having so much cash lying around. That is where a digital cash envelope system comes in.

A cashless envelope system works just like a real cash envelope system. But everything is virtual. Rather than being physical, your envelopes will be separate bank accounts or buckets if your bank has that option. Many banks allow you to open up multiple sub-accounts under your primary account.

There are even some banks with envelope budgeting. Keep reading to learn how to get started with virtual envelopes.

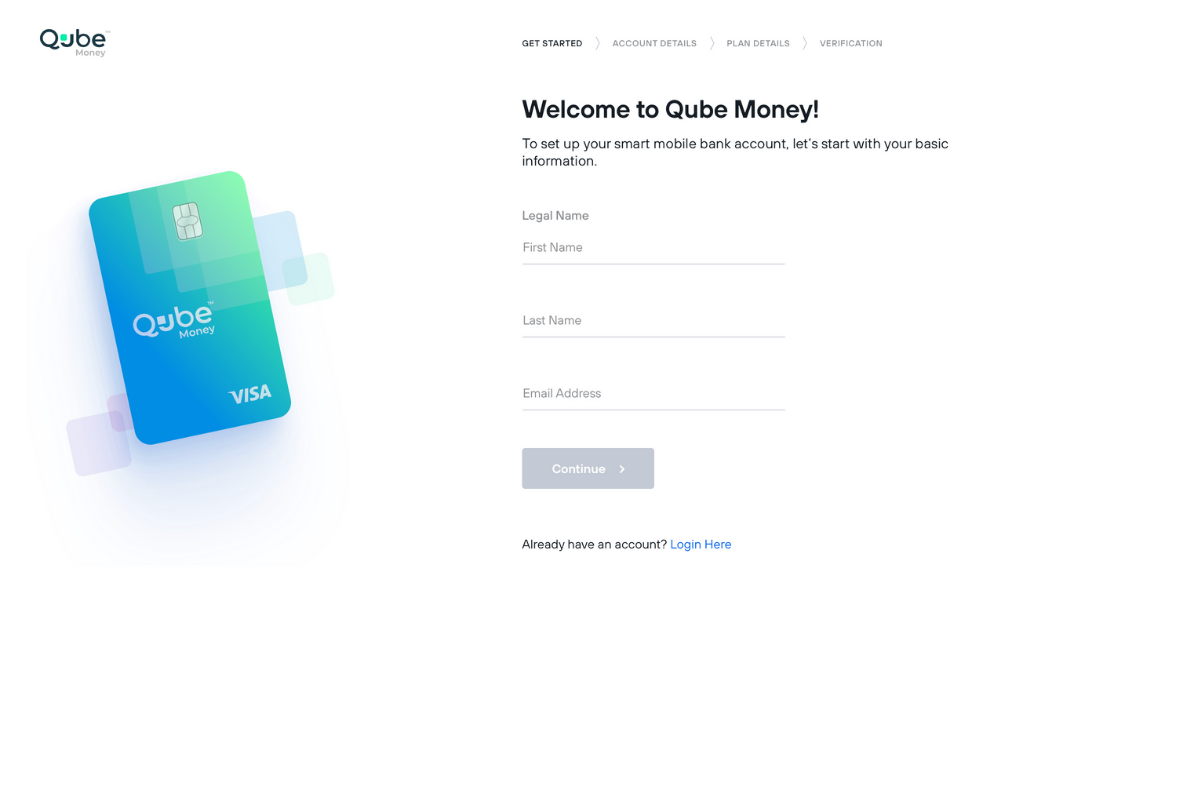

How to Get Started with a Virtual Envelope System

The first thing you need for a virtual envelope system is a bank with envelope budgeting. If your bank doesn’t have envelope budgeting per-say, you can still make this work. Just make sure they don’t charge fees for having multiple accounts with low balances!

Once you have found your bank, open a sub-account for each spending category. Label it accurately (e.g., Groceries) so you can keep track of things more easily. The most important part of any budget system is tracking expenses. A digital cash envelope system is no different.

You need to make sure you accurately track spending. So, say you start with $100 in your digital envelope for gas. A few days into the month, you spend $20 on gas on your credit card.

You would document the $20 purchase on your running log (could be a spreadsheet, app, or another budget program).

You could transfer that $20 from savings to checking right away. Keep in mind that federal law prevents you from making over 6 transfers per month from savings, though. Because of this rule, you might need to change your strategy. It may be better to track your expenses and make the transfer in a lump sum one or two times a month.

If this all sounds a little complex, it is because it can be.

Luckily, there is a better way. Keep reading for the best bank with an envelope budgeting system!

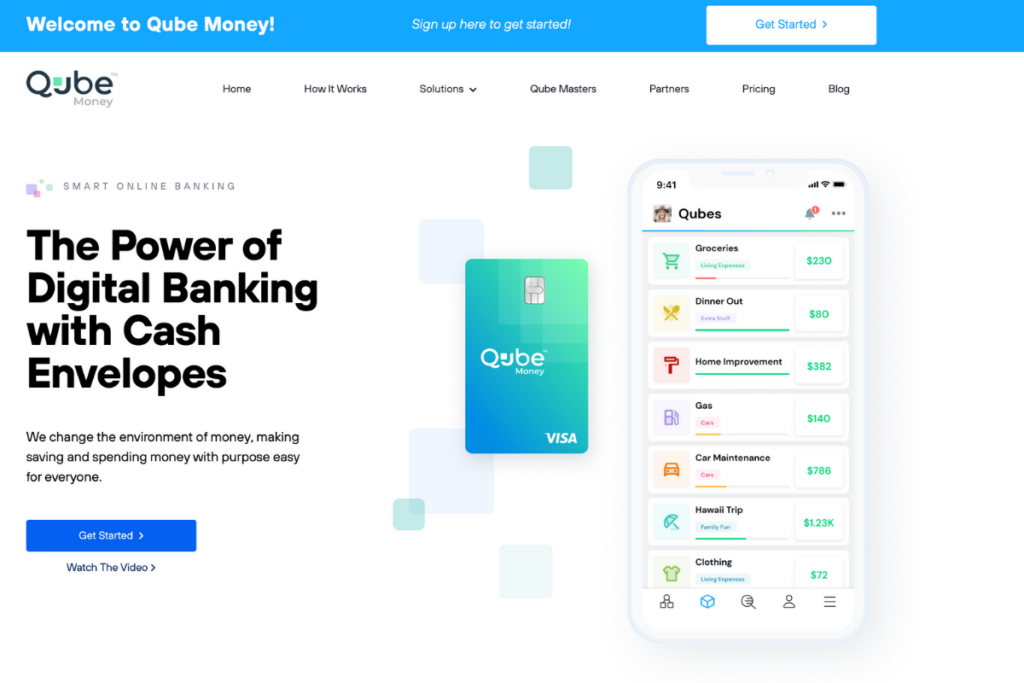

Qube Money- A Bank with Envelope Budgeting

If you don’t stick with your chosen budgeting system, it doesn’t do you any good. That’s why complex budgets are not your friend. Using a cashless cash envelope system with a regular bank can be challenging. This means you risk giving up and being stuck in the same frustrating cycle as before.

Not so with Qube Money! Implementing a digital cash envelope system with Qube is incredibly straightforward. This safe and simple app makes sticking to a budget easy.

How to Fund Qube Money Digital Cash Envelopes

You can easily deposit money into your FDIC-insured Qube account in several ways. One option is to link your external bank account electronically. Alternatively, you can add money with your bank debit card once a month if desired. You can even receive your paychecks via direct deposit straight to your Qube account.

After depositing the money, you decide how much money to put into each qube. A qube is essentially your digital cash envelope. The app lets you see exactly how much money is in each virtual envelope.

As of right now, anyone that signs up can have unlimited qubes and they are not actually charging anyone yet.

Basically anyone that signs up can get a free trial of everything that is currently available.

The premium features should be available this summer, which makes the app even more family friendly!

How to Spend Money Using Your Virtual Cash Envelopes

Your Qube account comes with a very special and, frankly outstanding, debit card. Most debit cards give access to every dollar in your checking account. That means if your card is lost or stolen, you could be stuck trying to get back as much money as you have in your checking account. Yikes, that is scary stuff!

The Qube debit card is different. It comes with an automatic balance of $0. To use the card, you will go into the app, select which qube you are spending from, simply tap the qube you want to spend from and all the money in that qube is immediately available to spend. If you try to spend more than what’s in the qube or you don’t tap the qube, the payment will decline.

After that, you swipe your card as usual at the store.

There are studies that show people who pay with cash spend less money. Up to 15-20% less than those who pay with a card. Seeing the money leave your qube helps unlock that feeling of spending cash. This feeling will help you spend wisely and save more.

After making a purchase out of a particular qube, the app will reflect the new balance instantly. It also logs all purchases so you can track spending from month to month. Seriously, such a game-changer!

Benefits of Digital Cash Envelopes

Now that you know what a digital cash envelope system is, why might you want to use it? There are several benefits to using a cashless envelope system.

One enormous benefit of using a cashless system is convenience. Lugging around cash or trying to deal with online purchases is just a hassle. Since you have to transfer money and see it leave your qube, you still get that “spending cash” feeling, though.

It also makes online purchases so much easier to deal with. Considering how much online shopping most people do nowadays, this is a definite pro.

Another benefit is that it helps you budget! You will see real-time data on how much money you have in each budget account. Once the money is gone, you have a few choices. You either have to stop spending or make a conscious effort to go outside your budget by adding extra money to your account. This drastically reduces overspending.

Finally, using digital cash envelopes is much safer than using cash. You won’t have to worry about losing your money. If you lose your traditional debit card, your financial institution will usually return your money. With Qube Money, your card is worthless unless you open a qube to spend from, making it even safer.

Drawbacks of Digital Cash Envelopes

All budgeting systems have their pros and cons. A digital cash envelope system is no different.

One drawback of using digital cash envelopes is the potential hassle. When trying to manage this system with your regular bank account, it can be a lot to keep track of. Luckily, Qube Money makes this much more straightforward.

Another thing some people dislike is having to constantly shuffle money around. However, this constant shuffle is what helps keep your spending in check. So, it is kind of a necessary evil in the virtual envelope system world.

It is also easier to swipe your card than to pay with cash. With a regular debit card cash envelope system in place, this problem doesn’t go away if you use the debt card. But you can use Apple Pay and Android Pay with Qube. So, you don’t even need the card.

Finally, if you run out of money in one category, you might be tempted to borrow from another. While you could do this and still stay within your overall budget, it makes things messier. You also run the risk of becoming lax in your budgeting and spending over time if you do this.

Frequently Asked Questions About Using a Digital Envelope System

Is using a Digital Cash Envelope System Safe?

Yes! In fact, it is likely much safer than using a real cash envelope system. Banks and other financial institutions like Qube Money are FDIC-insured and use encryption to protect your data and account information.

You can also increase security by using two-factor authentication and choosing a strong password. This is important for all online banking.

Who Should Use Cashless Cash Envelopes?

If you have ever gone over budget, a virtual cash envelope system is for you. Let’s be honest, we have all gone over budget one time or another. That means most people could benefit from trying this budget system. It is also an excellent choice for people who like to shop online or don’t enjoy carrying cash.

How Much Does Qube Money Cost?

Qube offers a 100% free plan! If you want additional options and features, they have monthly prices ranging from $8-$25. The cool thing with their paid plans is that they are adding a kids feature soon, so you can share an account with partners or kids. This helps the entire family stay on budget!

Got more questions? Watch the Q&A with Qube Money

Conclusion

If you have tried to budget before and failed, that doesn’t mean you are doomed! You probably just haven’t found the system that works best for you. I highly recommend everyone give the digital cash envelope system a try.

If you bank with an online bank that offers digital cash envelopes, the process is simple and effective. You will have a hard time overspending. You’ll also know exactly where your money goes each month. That way, if you do go over, you can make a plan to improve next month.

Starting a new budget system can be overwhelming. Once you get the hang of it, though, you will be so thankful you did. Getting your budget on track will literally change your life for the better. So why wait?

Get started with your virtual cash envelopes today!

- Go download the app

- Deposit $25

- Make one purchase

To try it out. I think you’ll love it once you try it!

Also be sure to check out Qube courses to learn more about managing your money with digital envelopes!