When you increase your wealth, the first step is to learn how to trim unnecessary spending habits. Let’s face it , nobody is perfect which means there is always room for improvement. In our personal lives as well as our financial life. Whatever it is, small changes can add up to significant savings over time.

Here are four steps that my husband and I did at GoodDinero that anyone can take to improve their spending habits:

1 – Track your spending for one week. Review your spending at the end of the week and see where you can cut back.

2 – Make a list of all your regular expenses, such as rent, utilities, transportation, groceries, etc. Determine which expenses are fixed and which are variable.

3 – Evaluate your variable expenses and see where you can cut back. For example, if you spend $50 per week on coffee, eating out, and other discretionary items, see if you can reduce that amount by even just $10.

4 – Automate your savings. Have a certain amount automatically transferred from your checking account to your savings account each month.

Now let’s explore some ways to trim your expenses further.

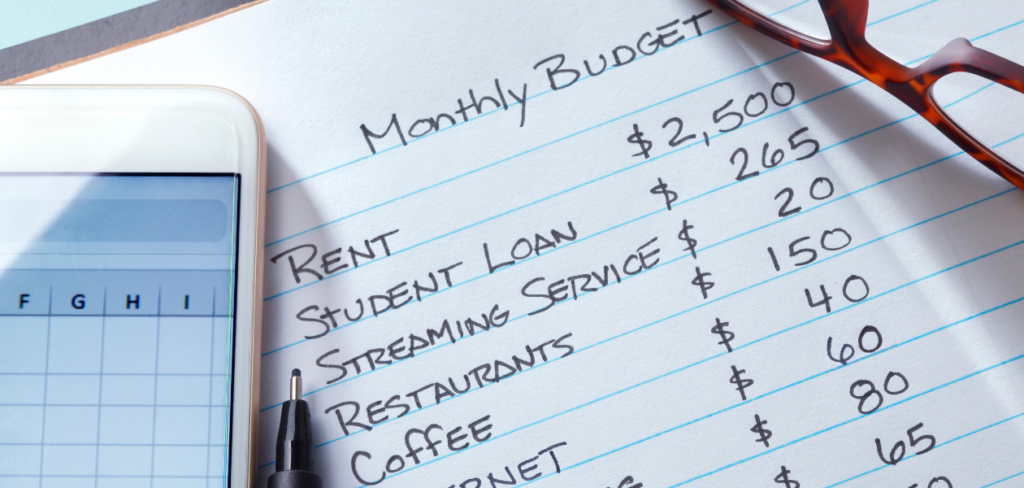

1. Start A Budget

Start trimming your spending habits with a budget. A budget is a great way to track your spending and see where you can cut back. You may be surprised how much money you can save by trimming your spending habits.

Let’s review the steps to start a budget:

1. Determine your income. This includes money from your job, investments, and other sources.

2. Make a list of all your regular expenses, such as rent, utilities, transportation, groceries, etc. Determine which expenses are fixed and which are variable.

3. Evaluate your variable expenses and see where you can cut back. For example, if you spend $50 per week on coffee, eating out, and other discretionary items, see if you can reduce that amount by even just $10.

4. Automate your savings. Have a certain amount automatically transferred from your checking account to your savings account each month.

5. Live below your means. One of the best ways to save money is to simply spend less than you earn. Try to keep your spending in line with your income and resist the temptation to overspend.

6. Make a plan. Once you know how much you need to save each month, make a budget and stick to it.

2. Track spending

There are a few key reasons why it is essential to track spending. First, you will be able to see where your money is going and identify overspending trends.

This can help you make necessary budget adjustments to free up more money for savings or other purposes.

Second, tracking your spending can also help you to spot any potential financial problems early on before they become unmanageable. This way you can take steps to address the situation and get back on track.

Finally, keeping tabs on your spending can give you a better overall understanding of your finances and where your money goes each month.

3. Shop with a List

When you make a list before shopping, you are more likely to stick to your budget and buy only the items you need. In addition, you can avoid impulse purchases by planning what you will buy ahead of time.

A shopping list also helps you save time in the store by knowing what you need to buy. In addition, having a list ensures that you won’t forget anything.

So next time you’re headed to the store, take a few minutes to make a list and see how much easier and cheaper your shopping trip is!

4. Eat At Home

Many people love going out to eat because it’s a chance to try new things and not worry about the cleanup. But eating out all the time can get expensive, and it’s not always the healthiest option. So if you’re looking to save money and eat healthier, here are a few tips for eating at home.

One way to ensure you’re eating at home more is to cook in bulk. Make a big batch of your favorite dish, and then freeze the leftovers. That way, you always have something quick and easy to reheat when you don’t feel like cooking.

You can also try meal planning. Sit down once a week and plan out what you’re going to make for each meal.

Then, do your grocery shopping based on that list. This will help you avoid buying things you don’t need, making cooking at home much less daunting.

Eating at home doesn’t have to be tedious. You can make it easy, affordable, and delicious with some planning.

5. Cancel Your Gym Membership

One way to save money is to cancel your gym membership. If you are not using your membership, then it is wasted money.

The untold truth is: you can get the same exercise if not a better one at home. Many people successfully get their exercise without ever setting foot in a gym.

Working out at home can be as effective as going to the gym. You can find online workouts or follow along with workout videos.

Additionally, there are plenty of exercises that you can do without any equipment at all. For example, bodyweight exercises like pushups, sit-ups, and squats are great for building strength and endurance.

There are many free or low-cost options for exercising outdoors. Going for walks or runs is a great way to get fresh air and improve cardiovascular health. And if you live near the sea, swimming is an excellent workout option.

So there is no need to keep paying for a gym membership you are not using. With a bit of creativity, you can find other ways to get exercise that is free or low-cost.

6. Drink More Water

Most of us know that we should be drinking more water. Not only is it good for our health, but it can also help us save money. After all, water is much cheaper than most other drinks on the market.

Despite its many benefits, many of us still find it hard to make water our go-to beverage. If you’re struggling to drink more water, here are a few tips that might help:

- Invest in a reusable water bottle and carry it with you everywhere you go. This will remind you to drink more water throughout the day.

- Add some flavor to your water by infusing it with fruit or herbs. This will make drinking more enjoyable, and you’ll be less likely to reach for sugary drinks instead.

- Keep track of how much water you’re drinking each day. Set a goal for yourself and strive to reach it every day.

Drinking more water can be difficult initially, but it’s worth it in the long run. Not only will you improve your health, but you’ll also save money on groceries and other drinks. So next time you’re thirsty, reach for a glass of water instead of that sugary soda. Your body (and your wallet) will thank you!

7. Make your own coffee

Anyone who has ever stepped foot in a Starbucks knows that coffee can be expensive. Even a simple cup of joe can cost upwards of $5 when you factor in milk, sugar, and other additives. So, cutting back on coffee expenses is a top priority for many people. A straightforward way to do this is to make your own coffee at home.

All you need is a pot of boiling water, a coffee filter, and your favorite coffee beans. This method allows you to control how much caffeine you consume and the strength of your coffee.

Best of all, it’s much cheaper than buying coffee from a café or restaurant. So if you’re looking to save money on your caffeine fix, making your coffee is the way to go.

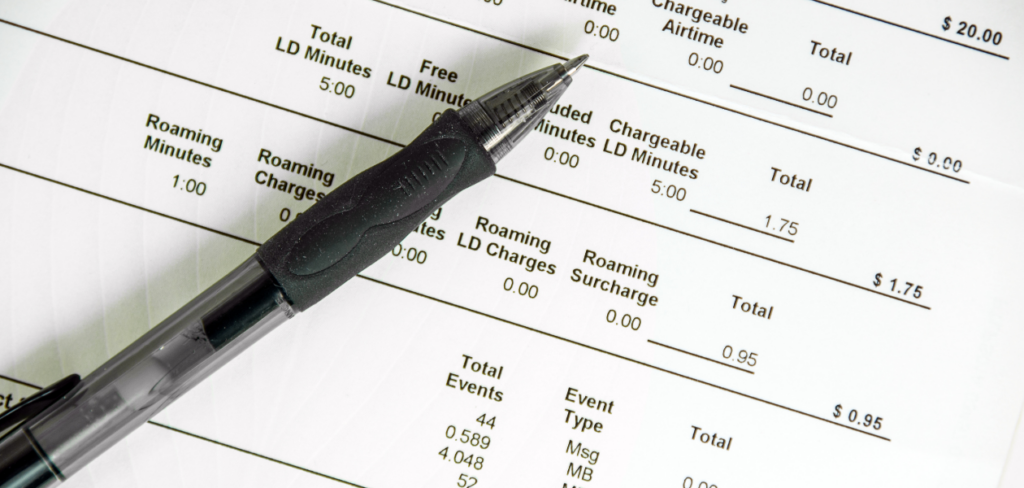

8. Switch your cell phone plan

If you’re like most people, your cell phone is one of your most important pieces of technology. You use it for everything from staying in touch with friends and family to checking the news and weather.

But if you’re not careful, your cell phone bill can quickly become one of your most significant monthly expenses.

Fortunately, there are a lot of excellent cell phone plans out there that can save you money every month.

For example, suppose you don’t use a lot of data. In that case, you might consider a lower-priced plan that doesn’t include unlimited data. Or, if you’re willing to switch to a different carrier, you could save a ton of money on your monthly bill.

Whatever route you decide to go, don’t be afraid to shop around and compare pricing before you commit to a new cell phone plan. A little research can go a long way in helping you save money on your monthly bill.

9. Wait a Day Before Making a Purchase

We’ve all been there – we see something we want and impulsively buy it, only to regret the purchase later. If you’re looking to cut back on your spending, one strategy is to wait 24 hours before making a purchase.

This will give you time to think about whether you really need the item and help you find a better deal.

For example, if you’re considering buying a new piece of clothing, wait 24 hours and see if you still want it. If you do, see if you can find it on sale or at a cheaper store.

By waiting just a day, you can save money and help control your spending. And who knows, after a day of thinking about it, you may decide that you don’t even want the item anymore!

So next time you feel the urge to splurge, take a step back and wait awhile – your wallet will thank you.

10. Borrow Instead of Buying for One-Time Projects

There’s no denying that buying new things can be fun. But let’s be honest – most of the time, we only use an item once or twice before it ends up sitting in the back of a closet gathering dust.

That’s why I’m a big advocate of borrowing instead of buying. Not only will you save money, but you’ll also avoid the hassle of storing the item after you’re done with it. This is especially helpful for big-ticket items like power tools or party supplies.

So next time you’re considering buying something new, ask yourself if you could borrow it. Chances are, you’ll be glad you did.

11. Use Coupons, Rebates and Discounts

Anyone who’s ever been to a store knows it’s easy to spend a lot of money there. But did you know there are ways to save money at almost any store?

Coupons, rebates and discounts can all help you get the items you want for less.

Many stores offer these savings opportunities, so take advantage of them when possible. Check the store’s website or ask a sales associate for more information on how to save money.

By taking advantage of these deals, you’ll be able to stretch your budget further and get more bang for your buck.

12. Drive a Different Car

If you’re looking to save money on your car, there are a few things you can do. For one, you don’t have to buy a brand new car, a cheaper, used model can be just as good.

Plus, if you have a good driving record, you may be able to get a discount on your car insurance. So, if you’re looking to save some money on your transportation costs, consider making a few changes to the way you purchase and insure your car.

You may be surprised at how much money you can save in the long run.

13. Cut the Cable Cord

One of the best things you can do is cut your cable cord. Cable TV is one of the most expensive monthly bills; getting rid of it can quickly lower your spending habits.

There are plenty of alternative ways to watch your favorite shows, including streaming services like Netflix and Hulu. So ditch the expensive cable bill and start saving today.

You might be surprised at how much money you can save by getting rid of your cable TV subscription. So why not give it a try? You may find that you don’t even miss it after a while.

14. Have pre-drinks at home

Going out for drinks can be a lot of fun. But it can also be expensive, especially if you’re buying rounds for your friends or trying to keep up with the bartenders.

That’s why more and more people are choosing to pregame at home before heading out for the night.

Pre-gaming is a great way to save money and still have a good time. Plus, you can control the environment and avoid overspending on drinks at a bar or club.

And if you drink responsibly by pacing yourself and having a designated driver, you can make sure you end the night on a high note. So next time you want to let loose, consider pre-gaming at home with some friends!

To conclude

Setting a budget, tracking your spending, and just shopping with a list, a beginner steps to trim your unnecessary spending habits.

Take a little time to evaluate how you currently spend your money to determine the best way to cut your expenses.

According to an article by McKinsey & Company, US consumers spent 18 percent more in March 2022 than they did two years earlier. From this, you can see that there is room for improvement in our spending habits.

With a few minor changes in your daily habits, you can improve your unnecessary spending and increase your wealth tremendously.

By finishing this article, you will have the tools to take your savings to the next level. Now, will you start trimming?